There are no laws against price gouging in New Zealand. Nevertheless, there really wasn't very much of it when it really really was needed - after the Christchurch earthquakes.

With the New York hurricane, price gouging is again making the rounds of the Econ blogosphere. Michael Giberson summarises things. Jeff Ely has concocted a scenario in which he thinks gouging worsens outcomes. I'm going to disagree with specific reference to the Christchurch experience.

Ely argues that we can have cases where supply is effectively fixed. Consequently, the only gains we get via gouging are in ensuring that goods are allocated to their highest valued use; we don't get increased supply. In that case, we weigh the gains from improved allocation against the losses to inframarginal consumers who have to pay more. Now, Ely's effectively ignoring producer surplus; he says producer surplus should only count when it can bring forth more supply. The better argument would simply specify that producers have lower marginal utility of income so the transfer is utility decreasing. I don't see why we otherwise would want to say that consumer surplus is so much better than producer surplus.

But, the Ely scenario really doesn't fit hurricanes. You get tons of prior warning for hurricanes and the opportunity to price gouge can bring in plenty of new supply. Not like an earthquake. And so let's go back to the Christchurch earthquakes.

After the February 2011 earthquake, we were in a zero-supply-elasticity world for a few goods, most notably petrol. More petrol was coming, but it wasn't going to be here for a few days. All of the petrol stations on the east side of town were out of commission due to power outages; it was very hard to figure out where you'd be able to find a petrol station with power if you lived in the east. Worse, because everyone knew that petrol was scarce, everyone panicked. If you had a car with half a tank, you filled it up. If you had two cars, you made sure both tanks were full. If you had empty jerry-cans, you filled those up too. A student this year told me that he was working as a security guard at one of the petrol stations after the quake. People were filling up barrels with petrol to keep in the garage. Eventually, the station started enforcing some rationing.

What radio reports we could get in the east noted very long petrol queues at the working stations in the west, with some selling out. We were in South Brighton, no power, a quarter tank of fuel [getting home post-quake took 5 freaking hours in traffic], and absolutely no clue whether our quarter tank would be enough to get us to a working station on the west side of town when we bugged out for a house with working sewerage, water and power.

EVERYBODY KNEW THAT PETROL WOULD BE BACK IN A FEW DAYS.

There were no laws against price gouging. But the petrol stations knew that every single customer would hate them if they were the only station to let prices rise such that supply and demand came back into equilibrium. And so because the stations didn't gouge, we were in a terrible equilibrium where everyone's rational response to the below-clearing price was to hoard, because there was real risk that the stations would run out of fuel. And there was real risk of running out of fuel because of the hoarding. Breaking the hoarding equilibrium would have required a coordinated price hike that both allocated fuel to its highest valued uses and told everyone that there would be fuel available for them in an emergency if they really really needed it. That latter part is crucial - it kills the incentive to hoard.

I take the Roth stuff on stupidity constraints seriously - we can't assume those away.* Any station doing the right thing would have taken a reputation hit that outweighed the private benefits to the station because customers are resentful idiots who do not understand how prices work. If the stations had gotten together to coordinate it, there would have been massive pressure for Commerce Commission action. The second-best alternative, given consumers who are idiots about price gouging, would have been a temporary very large hike in the petrol tax for Christchurch, with money raised being dedicated to earthquake relief. This, I think, is the right response when supply is perfectly inelastic and stupidity constraints bind. I argued for it as soon as I was again able to blog post-quake.** It should be a standing contingency plan for similar emergencies.

If there are big worries about hardship on poorer communities from the price increases, get a helicopter, get a bag of money, and drop the money over the poorer communities while letting prices rise. A better option, if stupidity constraints of another form didn't bind, would be to give everybody an emergency debit card pre-loaded with $200 that would only activate if a state of emergency were declared. But there's awfully strong odds that the folks who'd most need them would lose them or sell them prior to the emergency.

I really think Ely is underestimating just how much value there can be in getting to the right allocative solution, and how a good dose of gouging can break hoarding equilibria.

* He calls it "repugnant markets", where people view some kinds of transactions as being repugnant. When those kinds of preferences prevent efficient trades, I call them stupidity constraints. Semantics.

** Other posts on price-gouging summarised here.

Wednesday, 31 October 2012

Tuesday, 30 October 2012

Gareth Morgan on Housing Affordability

Posted by

Seamus Hogan

Gareth Morgan takes aim here at the Productivity Commission, for emphasising land supply as the major determinant of the high cost of housing in New Zealand. He notes that

First, explanations don't have to be either-or. Even if we agree that there are problems in New Zealand capital markets that contribute to house inflation, surely it would be the case that those problems are going to be more acute the lower is the elasticity of supply of land for housing?

Second, one of Gareth's concerns about the tax advantage given to housing is that it encourages people to buy housing as a path to prosperity, which presumably means that it is based on expected capital gain. Now this either means that house prices have been pushed up by a bubble, which will eventually burst without any change in the tax system, or that the fundamental price of housing is rising, and speculation is just bringing those price increases forward. If that is the case, then removing any favourable tax treatment on the capital gains from home ownership might cause a one-time drop in house prices now, but a faster increase in those prices in the future.

Third, Gareth's other concern about the favourable tax treatment given to housing--and the one that motivates Gareth's call for a capital tax--is the familiar fact that the implicit income earned from selling housing services to oneself in owner-occupied housing is not subject to income tax (although the transaction is implicitly subject to GST). This distortion will indeed cause the demand for housing to be higher than it otherwise would have been. But it will not cause the after-tax price of housing services to be higher, so again, it is hard to see how removing the tax distortion would be a solution to the problem the Productivity Commission are addressing.

Finally, if looking to the tax code to explain the change in house prices over time, or differences between countries in the fraction of income devoted to housing, one needs to identify time-series or cross-section differences in the tax code. Pretty much all countries have a tax code that favours owner-occupied housing and always have done. If anything, we have moved the tax code away from favouring housing in recent years with changes in the treatment of investment properties, and a switch from income tax to a higher rate of GST. And we don't have policies like the mortgage interest rate deduction that are seen in other countries, particularly the U.S.

Ultimately, it just comes down to ECON 100 supply and demand. The New Zealand population has been rising, and land-use policies have been preventing supply from keeping up with demand. Maybe those policies are a good thing, and we should be moving away from urban sprawl to high-density living. But it is hard to counter that the cost of such policies will be a steady increase in the price per square metre of housing.

[t]here are cities in the world with five times Auckland's population, living in an area no larger than Auckland's, and with housing prices lower as a percentage of income than in New Zealand.Gareth, in contrast, points the finger at the Reserve Bank for directing banks to emphasise mortgage lending (for prudential reasons), and the tax code for favouring housing. He says that as a result of this "toxic duo" we have

driven the price of housing from twice the average household income to six times.He restates his call for a capital tax (not a capital gains tax) to remove a distortion in favour of housing. Now, as I wrote here, I think that a capital tax has some really horrible properties that would swamp any benefits, but this is secondary to why I don't agree with this analysis of the NZ housing market.

First, explanations don't have to be either-or. Even if we agree that there are problems in New Zealand capital markets that contribute to house inflation, surely it would be the case that those problems are going to be more acute the lower is the elasticity of supply of land for housing?

Second, one of Gareth's concerns about the tax advantage given to housing is that it encourages people to buy housing as a path to prosperity, which presumably means that it is based on expected capital gain. Now this either means that house prices have been pushed up by a bubble, which will eventually burst without any change in the tax system, or that the fundamental price of housing is rising, and speculation is just bringing those price increases forward. If that is the case, then removing any favourable tax treatment on the capital gains from home ownership might cause a one-time drop in house prices now, but a faster increase in those prices in the future.

Third, Gareth's other concern about the favourable tax treatment given to housing--and the one that motivates Gareth's call for a capital tax--is the familiar fact that the implicit income earned from selling housing services to oneself in owner-occupied housing is not subject to income tax (although the transaction is implicitly subject to GST). This distortion will indeed cause the demand for housing to be higher than it otherwise would have been. But it will not cause the after-tax price of housing services to be higher, so again, it is hard to see how removing the tax distortion would be a solution to the problem the Productivity Commission are addressing.

Finally, if looking to the tax code to explain the change in house prices over time, or differences between countries in the fraction of income devoted to housing, one needs to identify time-series or cross-section differences in the tax code. Pretty much all countries have a tax code that favours owner-occupied housing and always have done. If anything, we have moved the tax code away from favouring housing in recent years with changes in the treatment of investment properties, and a switch from income tax to a higher rate of GST. And we don't have policies like the mortgage interest rate deduction that are seen in other countries, particularly the U.S.

Ultimately, it just comes down to ECON 100 supply and demand. The New Zealand population has been rising, and land-use policies have been preventing supply from keeping up with demand. Maybe those policies are a good thing, and we should be moving away from urban sprawl to high-density living. But it is hard to counter that the cost of such policies will be a steady increase in the price per square metre of housing.

Drink-driving kids

Posted by

Eric Crampton

The blood alcohol limit in New Zealand for those under 20 is 0%. For those over 20, it's 0.08.

It's worth keeping that in mind when you read stories giving the youth and adult arrest numbers:

Overall, youth arrest rates for drink driving are substantially down. The reporter here seems to have gotten it, even if the sub-editor went for the inaccurate but eye-grabbing headline "Teens turn blind eye to drink-driving". From the story:

A prior news story citing the same police figures gave a few more details:

So:

I would be awfully curious to know more about the actual BAC for those charged before and after the law change.

The best argument for reducing the adult drink driving limit from 0.08 to 0.05 isn't the reduction in accidents among the cohort of drivers who test in the 0.05 to 0.08 range - that's almost certain to be trivially small relative to their representation among the cohort of drivers who were not involved in accidents.* Rather, it's that many people may intend on having only a couple of drinks but, after having gotten to 0.06, decide to have a few more drinks. Since they hadn't planned on getting drunk, they didn't plan on a ride home. And so they may wind up driving home drunk. A lower drink driving limit's benefit might then be in reducing the likelihood of transitioning to heavier drinking when driving home.

The change to the 0% threshold did nothing to affect the penalties faced by 19 year olds (compared to, say, 23 year olds) for consuming amounts of alcohol over the 0.08 threshold for more severe penalties. But it might have affect their likelihood of making plans to have a designated driver or to drink at all. If a substantial proportion of the reduction in under-20s drink-driving arrests comes from reduced numbers of youths consuming past the 0.08 limit (relative to the trend for 23 year olds), then we put more weight on the potential for a 0.05 adult limit to reduce adults' likelihood of driving with BAC > 0.08. If not, then we downweight that potential.

In either case, full cost-benefit analysis would need to weigh benefits from accident reductions against reduced consumption benefits to those who would not have gone on to impose increased accident risk on others: many adults, me included, would substantially curtail consumption to guard against the risk of accidentally going over 0.05 even if the vast majority of the time we never exceeded 0.04. It is a mistake to note that most adults' typical consumption would keep them below 0.05 and that consequently moderate drinkers benefits from moderate consumption would not change. Think of it this way: if we had the death penalty for going over 105 kph if the speed limit were 100, and the police said this shouldn't matter because most people drive the speed limit anyway, it would be a bit nuts. It's easy to accidentally hit 105 even when you're trying hard to stay at 100. It's harder to hit 112 by accident. So the death penalty for driving 105 would likely have most folks stick to 90, just to be safe. Same with a drink driving limit of 0.05: risk-averse people would target 0.03 or below just to be safe. The loss in consumption benefits would be real, and we'd better be sure that the reduction in accident rates is then worth it.

And so I wonder if the Police is collecting data on actual BAC among those breath-tested, and whether time series data on that sorted by age is anywhere available.

* And this, boys and girls, is why the police's emphasis on testing the BAC of those involved in accidents to see what portion fell in the 0.05 to 0.08 range by itself really doesn't help us a ton in deciding whether to cut the limit to 0.05. If 10% of drivers on the road from 8 pm to 4 am would test at .05 to .08, then they'd have to show up in more than 10% of accidents during that time of day to be over-represented. Unless we combine that accident data with data from random police checkpoints to get time-of-day population baselines, we just won't know whether they're over, under, or proportionately represented.

It's worth keeping that in mind when you read stories giving the youth and adult arrest numbers:

The Group and traffic officers on Friday and Saturday had checkpoints around Tauranga, Mt Maunganui and Papamoa.Ten percent of drivers nailed being youths seems high relative to their proportion of the driving population, but the standard varies across cohorts.

Of the 22 drink drivers caught at the weekend only two were under the age of 20.''This is an encouraging sign that our youth are now in a position to set a benchmark for the rest of the community".

Overall, youth arrest rates for drink driving are substantially down. The reporter here seems to have gotten it, even if the sub-editor went for the inaccurate but eye-grabbing headline "Teens turn blind eye to drink-driving". From the story:

The number of teenagers arrested for drink-driving has halved almost a year after the zero alcohol limit was brought in for under-20s. Police figures show that in the first nine months since the law came into force on August 7 last year, 3091 youths aged 15 to 19 were arrested for drink-driving. The figure for the 12 months before the law change was 6414.Previously, the drink driving limit for youths under 20 was 0.03. Here's the relevant section from the Land Transport Act 1998. Prior to the law change, consumption of alcohol in the 0.03 to 0.08 range drew a maximum term of 3 months or a fine of up to $2250 and a 3-month license suspension. Those consuming over 0.08, as I understand things, would draw the standard adult range of penalties: maximum jail term of up to 3 months, a fine of up to $4500, and driving disqualification for at least 6 months. The 2011 law change added an infringement offence for consumption in the 0 to 0.03 range: a fine and 50 demerit points.

A prior news story citing the same police figures gave a few more details:

The average numbers of those charged for having 30mg or more had dropped by about 43 per cent since the law change - from two charges per day to 1.1.On average, the numbers of arrests for youth drivers falling within the ‘‘new range’’ of alcohol restrictions dropped from about 18 charges before the law was introduced to 12.6 since.I'm a bit confused by the stats on the 'new range'; I didn't think you could be arrested for being in the 0-0.03 range prior to the law change.

So:

- Drink driving arrest numbers are not commensurable pre- and post- the law change; if behaviour had not changed, we would expect arrest rates among youths to have increased substantially.

- That youth arrest rates dropped says that the bright line rule deterred behaviour.

I would be awfully curious to know more about the actual BAC for those charged before and after the law change.

The best argument for reducing the adult drink driving limit from 0.08 to 0.05 isn't the reduction in accidents among the cohort of drivers who test in the 0.05 to 0.08 range - that's almost certain to be trivially small relative to their representation among the cohort of drivers who were not involved in accidents.* Rather, it's that many people may intend on having only a couple of drinks but, after having gotten to 0.06, decide to have a few more drinks. Since they hadn't planned on getting drunk, they didn't plan on a ride home. And so they may wind up driving home drunk. A lower drink driving limit's benefit might then be in reducing the likelihood of transitioning to heavier drinking when driving home.

The change to the 0% threshold did nothing to affect the penalties faced by 19 year olds (compared to, say, 23 year olds) for consuming amounts of alcohol over the 0.08 threshold for more severe penalties. But it might have affect their likelihood of making plans to have a designated driver or to drink at all. If a substantial proportion of the reduction in under-20s drink-driving arrests comes from reduced numbers of youths consuming past the 0.08 limit (relative to the trend for 23 year olds), then we put more weight on the potential for a 0.05 adult limit to reduce adults' likelihood of driving with BAC > 0.08. If not, then we downweight that potential.

In either case, full cost-benefit analysis would need to weigh benefits from accident reductions against reduced consumption benefits to those who would not have gone on to impose increased accident risk on others: many adults, me included, would substantially curtail consumption to guard against the risk of accidentally going over 0.05 even if the vast majority of the time we never exceeded 0.04. It is a mistake to note that most adults' typical consumption would keep them below 0.05 and that consequently moderate drinkers benefits from moderate consumption would not change. Think of it this way: if we had the death penalty for going over 105 kph if the speed limit were 100, and the police said this shouldn't matter because most people drive the speed limit anyway, it would be a bit nuts. It's easy to accidentally hit 105 even when you're trying hard to stay at 100. It's harder to hit 112 by accident. So the death penalty for driving 105 would likely have most folks stick to 90, just to be safe. Same with a drink driving limit of 0.05: risk-averse people would target 0.03 or below just to be safe. The loss in consumption benefits would be real, and we'd better be sure that the reduction in accident rates is then worth it.

And so I wonder if the Police is collecting data on actual BAC among those breath-tested, and whether time series data on that sorted by age is anywhere available.

* And this, boys and girls, is why the police's emphasis on testing the BAC of those involved in accidents to see what portion fell in the 0.05 to 0.08 range by itself really doesn't help us a ton in deciding whether to cut the limit to 0.05. If 10% of drivers on the road from 8 pm to 4 am would test at .05 to .08, then they'd have to show up in more than 10% of accidents during that time of day to be over-represented. Unless we combine that accident data with data from random police checkpoints to get time-of-day population baselines, we just won't know whether they're over, under, or proportionately represented.

Academic centrefolds

Posted by

Eric Crampton

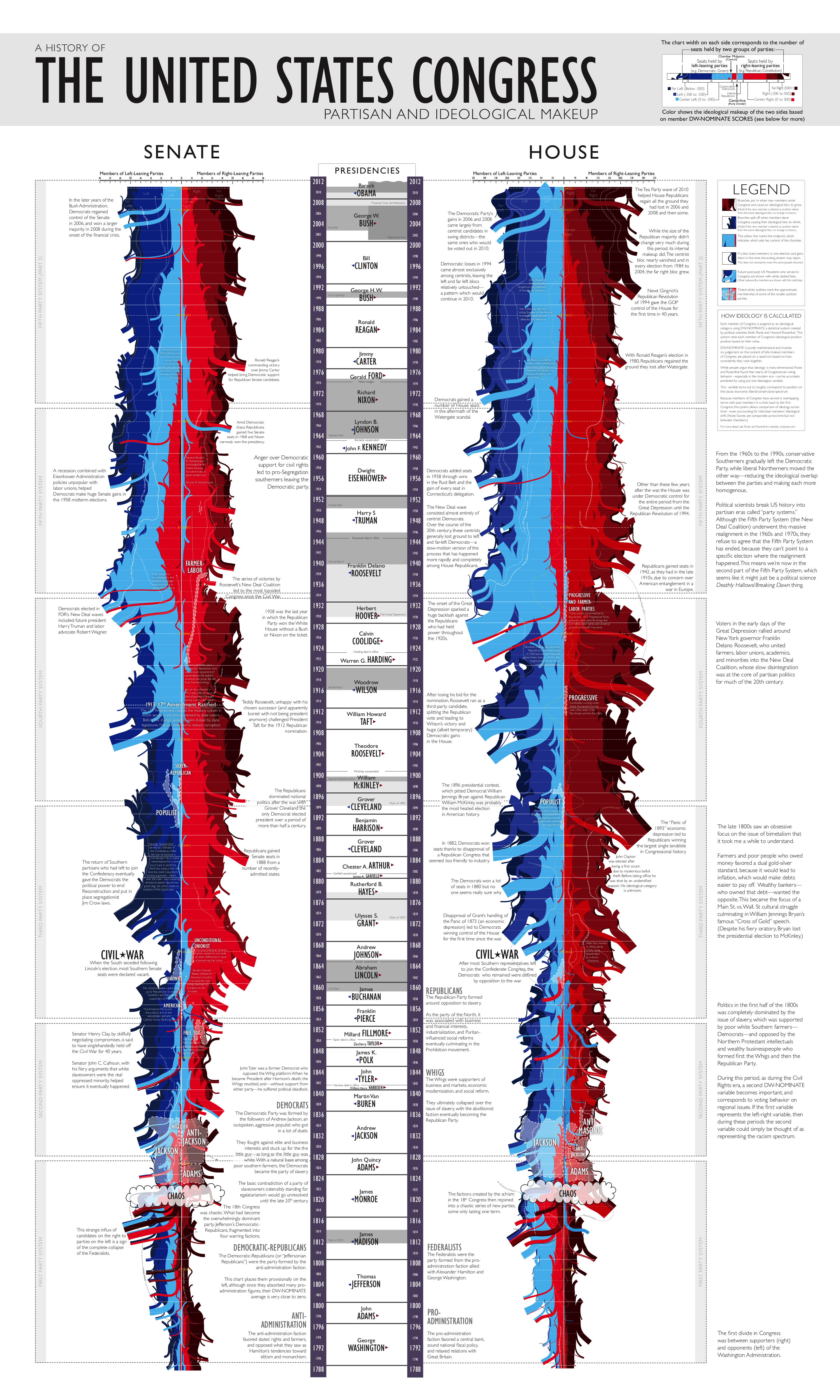

Public Choice has to get in touch with Randall Munroe right now. They need to get a licence to reproduce this as a centrefold in the next available issue.

DW-Nominate tracks Congressional ideology [and here] back to the start. What a beautiful way of illustrating it.

DW-Nominate tracks Congressional ideology [and here] back to the start. What a beautiful way of illustrating it.

Friday, 26 October 2012

Economist Irrationality

Posted by

Eric Crampton

Boy is S.M. at The Economist's "Democracy in America" blog having to engage in contortions to defend the rationality of voting.

Launching off from Katherine Mangu-Ward's really excellent summary of the case against voting, S.M. invokes Gelman's argument that large N elections both reduce the probability of decisiveness and increase the potential benefits from winning.

Worse, S.M. pulls a pretty shonky Kantian move.

The simplest and most plausible way of squaring voting with rationality is simply to recognize that people like doing it for its own sake. We don't try to come up with stories about how onanism increases reproductive fitness; it's done for its own sake. Same with voting. Unfortunately, that breaks most of the normative desirability of median voter outcomes.

Launching off from Katherine Mangu-Ward's really excellent summary of the case against voting, S.M. invokes Gelman's argument that large N elections both reduce the probability of decisiveness and increase the potential benefits from winning.

The mathematics are convoluted, but the message is simple: even with a one in 10m chance of casting the decisive vote, the stakes are high. In fact, the lower the odds are of influencing the vote, the higher the stakes. This is because everything scales linearly and more people will bear the brunt—or enjoy the benefits—of a country led by candidate X rather than candidate Y. So your vote in Ohio, Wisconsin or another tipping-point state is worth $60,000 to your fellow citizens. That’s a pretty good return on the investment of the hour or so it takes to vote.Except that the very fact of your decisiveness in the election proves that half of all voters disagree about whether you're making the world a better or a worse place! You can only be decisive by making or breaking a tie. That happens when half the voters think you're rather wrong. And, unless you are in an epistemically privileged situation relative to other voters (and why would you think you are!), you can't know whether you're on the right side or the wrong side. Gelman's a great statistician, but I've never liked his argument here.

Worse, S.M. pulls a pretty shonky Kantian move.

This misses the point of the Kantian argument for voting. The idea is not that one person’s decision to forgo voting would crash the system—how would that possibly happen?—but that it is immoral to act on a maxim that we cannot imagine everyone else acting on. So if I consider adopting Ms Mangu-Ward’s proposed maxim—I will abstain from voting because the costs of voting outweigh the benefits—I will first need to see if the maxim passes a test implicit in Kant’s categorical imperative. I ought not act in accordance with the maxim if it fails the test.Here's the universalisable version. Two weeks before the election, flip a coin. If it comes up heads, flip it again. If it comes up heads, flip it again. If it comes up heads a third time (a 12.5% chance), study hard about the policy options, decide which candidate is best, and then go vote. If everybody does that, there's a non-trivial chance of being decisive (maybe we'd need four heads in a row to be more sure) and so you've an instrumental reason to get out and vote - and to vote more sensibly. At current levels of turnout, it's clear that everybody else is failing to play the universalisable Kantian "vote at low probability" rule, so a good rule of thumb is then "Don't vote unless turnout looks low enough; if turnout is low, run the coin flips."

So let’s see: can I universalise the non-voting maxim? Can I imagine living in a world in which every eligible voter opts for a nap or a game of Temple Run in lieu of going to the polls? No. The logic of American democracy does not support such a universalised principle. No one votes, no one is elected, a moment of constitutional failure brings an emergency convention in which unelected delegates draft a new constitution calling for an alternate system of specifying leaders that doesn’t involve the public. The franchise, and America as we know it, disappears. Since the logic of the system cannot be sustained were everyone to adopt the nap-over-voting maxim, I am morally bound not to act on it.

The simplest and most plausible way of squaring voting with rationality is simply to recognize that people like doing it for its own sake. We don't try to come up with stories about how onanism increases reproductive fitness; it's done for its own sake. Same with voting. Unfortunately, that breaks most of the normative desirability of median voter outcomes.

Good graphs are general, or how a carbon tax is like drug legalisation

Posted by

Eric Crampton

Stephen Gordon ably makes the case for market mechanisms over regulatory approaches to dealing with climate change. The deadweight costs of achieving any arbitrary level of greenhouse gas reduction are lower either under emissions trading or a carbon tax as compared to using regulations like "You must use Technology X" or "You may not use Technology Y.".*

Stephen illustrates with a couple of handy graphs. They're also graphs that I use in my Economics and Current Policy Issues class, but in an entirely different context.

Here's the welfare effect of a regulatory approach. Stephen writes:

I use exactly the same graphs to illustrate the superiority of tax based approaches over drug prohibition in my Economics and Current Policy Issues course at Canterbury. Prohibition is a negative technology shock for producers involving real increases in production costs. The same consumption reduction can equivalently be achieved by a legalised system that uses taxes as consumption deterrent, and with a similar transformation of deadweight cost into tax revenue. You can make it more complicated by saying that the demand curve shifts out under legalisation and by noting that there are tax levels beyond which you induce black market providers to enter the system; I take these as suggesting you can't really have a retail price under legalisation that's above the current black market price. Whether we then have any substantial consumption increase is more of an empirical question; Portugal's experience suggests it not to be the case.

* I still put reasonable weight on that this may not be the best approach for New Zealand. If everyone in the world were doing carbon trading or carbon taxes, we'd want to as well. But, realistically, if New Zealand were to disappear into outer space tomorrow, it's pretty unclear that the entire abolition of New Zealand's net greenhouse gas emissions would do much on aggregate warming outcomes. Maybe we'd delay the onset of any particular level of GHG accumulation by a half day over a century. In that case, New Zealand could perhaps do better by picking high variance plays despite their lower expected mean. Pour money into biotech research for low GHG pastoral systems and give the resulting technology away to anybody who wants to use it. Lower expected returns, but if it pans out, it could reduce GHG emissions by a heck of a lot more than NZ could achieve on its own via domestic incremental reductions in carbon or methane emissions.

Stephen illustrates with a couple of handy graphs. They're also graphs that I use in my Economics and Current Policy Issues class, but in an entirely different context.

Here's the welfare effect of a regulatory approach. Stephen writes:

Regulations essentially have the same effect of a technical setback: they oblige suppliers to undertake practices that increase the cost of production. This has the effect of shifting the supply curve up: Faced with higher costs, producers are going to raise the minimum price they’ll accept for any given quantity produced. This upward shift increases prices and reduces quantities produced, which is of course the policy goal. It also affects the producer and consumer surplus:He then explains why the welfare loss is the entire green trapezoid, before illustrating the alternative approach:

Suppose now that instead of regulations, the government imposes a tax on the sale of the good. This also shifts up the supply curve, as producers will now require prices that offset the extra cost of the tax. The difference here is that government revenues are now introduced into the graph:A good chunk of what was deadweight cost is now crunchy tasty tax revenue.

I use exactly the same graphs to illustrate the superiority of tax based approaches over drug prohibition in my Economics and Current Policy Issues course at Canterbury. Prohibition is a negative technology shock for producers involving real increases in production costs. The same consumption reduction can equivalently be achieved by a legalised system that uses taxes as consumption deterrent, and with a similar transformation of deadweight cost into tax revenue. You can make it more complicated by saying that the demand curve shifts out under legalisation and by noting that there are tax levels beyond which you induce black market providers to enter the system; I take these as suggesting you can't really have a retail price under legalisation that's above the current black market price. Whether we then have any substantial consumption increase is more of an empirical question; Portugal's experience suggests it not to be the case.

* I still put reasonable weight on that this may not be the best approach for New Zealand. If everyone in the world were doing carbon trading or carbon taxes, we'd want to as well. But, realistically, if New Zealand were to disappear into outer space tomorrow, it's pretty unclear that the entire abolition of New Zealand's net greenhouse gas emissions would do much on aggregate warming outcomes. Maybe we'd delay the onset of any particular level of GHG accumulation by a half day over a century. In that case, New Zealand could perhaps do better by picking high variance plays despite their lower expected mean. Pour money into biotech research for low GHG pastoral systems and give the resulting technology away to anybody who wants to use it. Lower expected returns, but if it pans out, it could reduce GHG emissions by a heck of a lot more than NZ could achieve on its own via domestic incremental reductions in carbon or methane emissions.

Thursday, 25 October 2012

Texting while driving

Posted by

Eric Crampton

Texting while driving is dangerous and increases your chance of accidents. Bans on texting while driving seem to increase accident rates.

So, here's a potential difference-in-difference study in this, the "thinking about honours projects for next year" time of year.

New Zealand banned texting while driving a few years ago. If we can get data on age-by-age participation in texting (presumably more prevalent among young people than among older people), we'd expect that the ban would have no effect on older cohorts' rates of single-vehicle accidents, that accident rates among youths will depend on the elasticity of texting risk-taking with respect to the law (could go either way - if the number of texting kids drops enough to offset the increased risk-taking by those still texting, accident rates drop; otherwise, they increase), and that multivehicle accident rates will change proportionately to the types of drivers involved (no change to multivehicle accidents where elderly drivers smash into each other, other cross-effects depend on the elasticity found in the single-vehicle accident rates).

Data we need:

The Insurance Institute for Highway Safety says that 3 of every 4 states that have enacted a ban on texting while driving have seen crashes actually go up rather than down.It's hard to pin down exactly why this is the case, but experts believe it is a result of people trying to avoid getting caught in states with stiff penalties. Folks trying to keep their phones out of view will often hold the phone much lower, below the wheel perhaps, in order to keep it out of view. That means the driver's eyes are looking down and away from the road.

So, here's a potential difference-in-difference study in this, the "thinking about honours projects for next year" time of year.

New Zealand banned texting while driving a few years ago. If we can get data on age-by-age participation in texting (presumably more prevalent among young people than among older people), we'd expect that the ban would have no effect on older cohorts' rates of single-vehicle accidents, that accident rates among youths will depend on the elasticity of texting risk-taking with respect to the law (could go either way - if the number of texting kids drops enough to offset the increased risk-taking by those still texting, accident rates drop; otherwise, they increase), and that multivehicle accident rates will change proportionately to the types of drivers involved (no change to multivehicle accidents where elderly drivers smash into each other, other cross-effects depend on the elasticity found in the single-vehicle accident rates).

Data we need:

- Age-by-age texting participation rates (don't know if any proxy exists)

- Age-by-age accident rates (near certain this exists)

- Accidents broken down by ages of all drivers involved and single- or multi-vehicle status

- Checking whether other age-specific interventions coincided with the texting law change:

- The zero-alcohol limit for young drivers (which itself would make for a great diff-in-diff study not only on accident rates but also on crime rates)

- The 'Crusher Collins' crackdown on 'boy racers'

Wednesday, 24 October 2012

Nutty about the alcohol purchase age

Posted by

Eric Crampton

CloseUp tonight (24 October) featured David Nutt on New Zealand's alcohol reforms. In the clip below, he says that New Zealand's lowering of the drinking age [actually, the alcohol purchase age] provides example of the increased harms and increased traffic accidents that eventuate.

Here is the best evidence we have on the effect of lowering the alcohol purchase age on traffic accidents.

It is hard to see evidence of substantial harm consequent to New Zealand's lowering of the alcohol purchase age from 20 to 18.

Here is the best evidence we have on the effect of lowering the alcohol purchase age on traffic accidents.

It is hard to see evidence of substantial harm consequent to New Zealand's lowering of the alcohol purchase age from 20 to 18.

Labelling and non-tariff barriers

Posted by

Eric Crampton

David Farrar asks why we shouldn't mandate nutritional labelling on alcoholic beverages. People may well forget that alcohol has caloric content; providing information has value.

Here's the case against them.

First, it is fairly easy for large producers of homogeneous products to add nutritional labels to their products. The one-off testing and label re-jigging is a fixed cost that is spread across a very large number of units. But, suppose you're a craft brewer and you get a notion to make a seasonal autumnal ale with pumpkin in it. It'll taste good and sell well as a small batch. But after you make a batch, you're going to have to send a bottle to the lab for testing, wait for the results, and attach the appropriate nutritional label to your new brew. This will add maybe a fortnight or more to your brewing cycle on the first batch of the product and cost you a bit in testing. You can't spread those costs over many units because you're not making many units. And heaven help you if you decide you should double the pumpkin in the next batch.

Second, it's a non-tariff barrier against imported products made in countries that do not have labelling requirements. When New Zealand implemented labelling requirements for standard drinks a few years ago, the shop where I bought my oddball foreign grey market craft beers had to print off little labels for each bottle of the one-offs that they sold, converting the percent alcohol content into a number of standard drinks. This added to the cost of foreign craft beer relative to domestic or mass market product.

You will rightly note that this is also an argument against mandatory nutritional labelling requirements on any small volume products.

If there's any steam behind nutritional labelling requirements, there are things we can do to make it less awful.

The easiest labelling requirement would only require that producers give a general range of calories contained per serving of the product based on the alcohol content alone. A gram of alcohol has seven calories, so a standard drink contains 70 calories. Most products could then simply say something like:

Here's the case against them.

First, it is fairly easy for large producers of homogeneous products to add nutritional labels to their products. The one-off testing and label re-jigging is a fixed cost that is spread across a very large number of units. But, suppose you're a craft brewer and you get a notion to make a seasonal autumnal ale with pumpkin in it. It'll taste good and sell well as a small batch. But after you make a batch, you're going to have to send a bottle to the lab for testing, wait for the results, and attach the appropriate nutritional label to your new brew. This will add maybe a fortnight or more to your brewing cycle on the first batch of the product and cost you a bit in testing. You can't spread those costs over many units because you're not making many units. And heaven help you if you decide you should double the pumpkin in the next batch.

Second, it's a non-tariff barrier against imported products made in countries that do not have labelling requirements. When New Zealand implemented labelling requirements for standard drinks a few years ago, the shop where I bought my oddball foreign grey market craft beers had to print off little labels for each bottle of the one-offs that they sold, converting the percent alcohol content into a number of standard drinks. This added to the cost of foreign craft beer relative to domestic or mass market product.

You will rightly note that this is also an argument against mandatory nutritional labelling requirements on any small volume products.

If there's any steam behind nutritional labelling requirements, there are things we can do to make it less awful.

The easiest labelling requirement would only require that producers give a general range of calories contained per serving of the product based on the alcohol content alone. A gram of alcohol has seven calories, so a standard drink contains 70 calories. Most products could then simply say something like:

"One serving of this product provides 50-100 calories through its alcohol content."

If you really want to know the protein, carbohydrate, sugar and salt content for the drinks, carve out an exemption for small-batch products and for imported products.

I really love the oddball small-batch beers that turn up in New Zealand, whether made domestically or imported. Anything that adds fixed costs helps to kill that product range. New Zealand has enough problems with fixed costs without inventing more of them.

You can't kill a bad stat

Posted by

Eric Crampton

The New Zealand Drug Foundation should know better. And yet, here we are.

The NZDF put up a Bingo card for those who support tougher regulations around alcohol with the catch-phrases they expect to show up in the debates around the Alcohol Reform Bill. The last page of it has a few problems. Alcohol Reform Bill Bingo Among the facts, as NZDF sees things:

So I hit their provided link. It's a redirect that goes to an article by Sally Casswell. That article provides results from a survey where they asked a representative sample of people a bunch of questions, including whether they know anybody who they consider to be a heavy drinker. 29% of the sample reported knowing at least one heavy drinker. Now it would be a really really big mistake to extrapolate from the number of heavy drinkers known by people in the sample to a population estimate of the number of heavy drinkers because respondents could easily be referring separately to the same heavy drinker. And, Casswell doesn't do that. In fact, there's absolutely nothing at the link to back up NZDF's claim here. I think this is likely a redirect error: the study backs up the number in the next factoid, where they say "about a third of New Zealanders have at least one heavy drinker in their lives" (note that 29% is almost equidistant from a quarter and a third for rounding purposes. Since a third is 33.333% and a quarter is 25%, a third is just a pinch worse for rounding purposes than a quarter, if you want to be accurate and you like fractions. But you always round up if you want the scarier fraction).

But, because I work in this literature, I know where their number comes from. It's from an old ALAC report, cited here. What counts as an "uninhibited binge drinker"? It's awfully hard to tell from the report. They define it as:

At page 75, the ALAC report compares uninhibited binge drinkers who drink every two to three days and who drank 7+ drinks on the last occasion with those who don't. The heavier drinking members of the uninhibited drinking cohort are more likely to be full time salary or wage earners, have higher income, and are more likely to drink with friends than to drink alone. Are any of those bad things?

But, the worst stat in NZ Drug's "Facts"? This one.

The NZDF put up a Bingo card for those who support tougher regulations around alcohol with the catch-phrases they expect to show up in the debates around the Alcohol Reform Bill. The last page of it has a few problems. Alcohol Reform Bill Bingo Among the facts, as NZDF sees things:

It's a small number who are ruining itOk. First off, there are 4.4 million people in New Zealand. They're claiming 1.3 million is a third of all drinkers. So they're claiming that we have 3.9 million drinkers in the country. At the 2001 census, there were about 848,000 people aged under 15. So the New Zealand Drug Foundation is claiming that every single person aged over 15, along with 41% of all of those aged 0-14, are drinkers. That seems off.

Since when is 785,000 a small number? That's how many "uninhibited binge drinkers" there are in New Zealand. A further 622,000 people are "constrained binge drinkers". Together that's 1.3 million people, about a third of all drinkers in New Zealand who are not drinking responsibly.

nzdrug.org/smallnumber

So I hit their provided link. It's a redirect that goes to an article by Sally Casswell. That article provides results from a survey where they asked a representative sample of people a bunch of questions, including whether they know anybody who they consider to be a heavy drinker. 29% of the sample reported knowing at least one heavy drinker. Now it would be a really really big mistake to extrapolate from the number of heavy drinkers known by people in the sample to a population estimate of the number of heavy drinkers because respondents could easily be referring separately to the same heavy drinker. And, Casswell doesn't do that. In fact, there's absolutely nothing at the link to back up NZDF's claim here. I think this is likely a redirect error: the study backs up the number in the next factoid, where they say "about a third of New Zealanders have at least one heavy drinker in their lives" (note that 29% is almost equidistant from a quarter and a third for rounding purposes. Since a third is 33.333% and a quarter is 25%, a third is just a pinch worse for rounding purposes than a quarter, if you want to be accurate and you like fractions. But you always round up if you want the scarier fraction).

But, because I work in this literature, I know where their number comes from. It's from an old ALAC report, cited here. What counts as an "uninhibited binge drinker"? It's awfully hard to tell from the report. They define it as:

"adults, 18+, who are less concerned with the effects of their drinking and less inhibited than Constrained Binge Drinkers. They drink regularly (often every day) and binge, mainly to unwind, and for the "buzz" and enjoyment."By my best guess, adults who drink regularly, who sometimes binge, count as "uninhibited" if they don't seem sufficiently contrite about it in the survey questions. At page 25, they say that the main difference between constrained and unconstrained bingers are "demographic and attitudinal characteristics", with the unconstrained exhibiting a more reckless disregard for downside costs of heavy drinking. What counts as binge drinking?

"where an adult reports they have consumed the equivalent of seven (7) or more glasses of alcohol during a single drinking session."I'll assume that they're there meaning standard drinks. Seven standard drinks, 70 grams of alcohol, is the equivalent of most of a bottle of standard strength wine (a bottle usually has 8-9 standard drinks). A half-litre of Emerson's JP is 3.27 standard drinks. So less than two pints of the JP makes you a binge drinker. Since I have about 0.6-1.3 standard drinks per typical day and perhaps once every month or two have something more like a couple pints of JP (over 3+ hours), and because I really can't see any negative consequences from my drinking pattern, I might count as an uninhibited binge drinker - it depends how often you have to binge to fall into the category. Figure 4 of that report shows that 56% of "uninhibited binge drinkers" had 3 or fewer drinks on their last drinking occasion; 25% of that category consumed 7 or more drinks on their last drinking occasion. So it's not implausible that a lot of people fall into the category. But does the category really tell us a ton about anything useful?

At page 75, the ALAC report compares uninhibited binge drinkers who drink every two to three days and who drank 7+ drinks on the last occasion with those who don't. The heavier drinking members of the uninhibited drinking cohort are more likely to be full time salary or wage earners, have higher income, and are more likely to drink with friends than to drink alone. Are any of those bad things?

But, the worst stat in NZ Drug's "Facts"? This one.

The status quo is fine.I don't know about the 1000 deaths; I hope that it's net of the lives saved by moderate drinking, but I doubt it. The 785,000 binge drinking figure seems a bit off, as noted above. The $72m figure is included in the $4.8 billion figure. And, the $4.8 billion is not a cost to the taxpayer. Again, here's BERL's cost tally:

The status quo means 1000 deaths due to alcohol every year. It means 785,000 binge drinkers. It means $72,000,000 in costs for Police, Corrections and health expenditure. It means $4.8 billion in costs to the taxpayer. The status quo means more harm.

nzdrug.org/alcoholreform

- $1.52 billion in intangible costs of loss of life (the vast majority of which is reduced life expectancy among very heavy drinkers, with no accounting for increased life expectancy for moderate drinkers);

- $1.48 billion in labour costs of lost productivity (the vast majority of which are the forgone production of the prematurely deceased, and consequently is double-counted with the $1.52 billion above since the Value of a Statistical Life is inclusive of lost production);

- $699 million in "drug production costs", including every cent of excise paid to the government by heavy drinkers;

- $562 million in crime costs, with a ridiculously low threshold for determining what is an "alcohol-caused crime";

- $290 million in health care costs, under the assumption that there are no health benefits from moderate drinking and by zeroing-out the effects of drinking for those disorders where even fairly heavy alcohol consumption reduces the costs of that disorder;

- $200 million in road crash costs, consisting both of those very real costs that drink drivers impose on others and the costs that drink drivers impose on themselves by wrecking their cars;

- $42 million in lost quality of life, again mostly falling on heavy drinkers themselves.

When I'd gone through the figures it looked like maybe $967 million of BERL's $4.8 billion could count as an external cost by more normal method.

It's hard to kill a bad stat. Darned things keep popping up whenever somebody finds them to be convenient.

The Unemployable and the Unemploying

Posted by

Eric Crampton

Well, which is it then? Are large hikes to minimum wages desirable because they transfer money to low wage workers with no real disemployment effects, or because they get rid of those jobs that shouldn't be there anyway?

Early American advocates of the minimum wage sought its disemployment effects, to make "unemployable" those whose employment was undesirable: immigrants who would "under-live" upstanding American workers, and women whose proper place was in the kitchen rather than in employment binders.

Most advocates of higher minimum wages in New Zealand point to recent American studies showing little disemployment effect of minimum wages. And they're right: the most recent American work does show little measurable effect. Minimum wages are far lower there; non-binding constraints largely fail to bind. The effects on poverty aren't that simple though: the products of minimum wage workers are disproportionately bought by poorer people; incidence analysis warns that a reasonable proportion of mandated wage hikes will be passed through to customers. And, in places like Canada where the minimum wage is higher and more binding, there's some evidence that minimum wage hikes increase poverty: the losses to families losing second-earners because of disemployment effects outweighed the gains to those families enjoying a small salary increase.

Here's Chris Trotter with an alternative take. After reasonably critiquing Labour Leader David Shearer's immigrant-bashing, Trotter reads the tea leaves:

Is Trotter there really saying that part of the point of a minimum wage is to clear out firms employing low-cost labour? Where the old-school Americans wanted to make undesirables 'unemployable', Trotter seems to want to make lower productivity firms 'unemployingable'.

You can maybe build a model where this works. Specify that workers are really really sticky with a current employer: actual wage differences from shifting jobs have to be really high before they'll engage in any search or entertain new job offers. Other, more efficient, employers would love to hire them, but they can't. You'll also have to specify either that markets for corporate control are just broken, preventing the takeover of less efficient firms by more efficient management, or that the firms are in sectors that are simply inherently less productive. Killing those firms allows the workers to shift over to alternative, more productive, employment. It sure doesn't seem a plausible model though.

Further, it can often be the case that lower skilled workers are complements to higher skilled workers. Here at Canterbury, a few years before the earthquakes, the University got rid of some of the cleaners and started making staff empty their own waste baskets into central bins on each floor of each Department.* It saved on some low cost workers' salaries, but at a higher and unmeasured opportunity cost. For every low productivity firm that's killed by Trotter's prescription, how many lower productivity tasks in higher productivity firms are also ended? What do we do with those whose endowment of human capital means that their marginal revenue product will never be higher than the current minimum wage?

* The veneer: sustainability, we should be throwing less stuff out, etc.

Early American advocates of the minimum wage sought its disemployment effects, to make "unemployable" those whose employment was undesirable: immigrants who would "under-live" upstanding American workers, and women whose proper place was in the kitchen rather than in employment binders.

Most advocates of higher minimum wages in New Zealand point to recent American studies showing little disemployment effect of minimum wages. And they're right: the most recent American work does show little measurable effect. Minimum wages are far lower there; non-binding constraints largely fail to bind. The effects on poverty aren't that simple though: the products of minimum wage workers are disproportionately bought by poorer people; incidence analysis warns that a reasonable proportion of mandated wage hikes will be passed through to customers. And, in places like Canada where the minimum wage is higher and more binding, there's some evidence that minimum wage hikes increase poverty: the losses to families losing second-earners because of disemployment effects outweighed the gains to those families enjoying a small salary increase.

Here's Chris Trotter with an alternative take. After reasonably critiquing Labour Leader David Shearer's immigrant-bashing, Trotter reads the tea leaves:

This means that any Labour government led by Shearer is likely to shy away from direct interventions in the labour market. It will not pass legislation designed to reverse the flow of wealth from wage and salary earners to owners and shareholders. It will not, by substantially lifting the minimum wage, engineer a wholesale winnowing-out of New Zealand's most inefficient businesses. It will not pass legislation restoring universal union membership or the national award system. It will not use the government's ability to set wages and salaries in the public sector to provide both a guide and a goad for private sector employers. In short, it will not do any of the things required to raise the incomes of New Zealand's wage and salary earners. [emphasis added]

Is Trotter there really saying that part of the point of a minimum wage is to clear out firms employing low-cost labour? Where the old-school Americans wanted to make undesirables 'unemployable', Trotter seems to want to make lower productivity firms 'unemployingable'.

You can maybe build a model where this works. Specify that workers are really really sticky with a current employer: actual wage differences from shifting jobs have to be really high before they'll engage in any search or entertain new job offers. Other, more efficient, employers would love to hire them, but they can't. You'll also have to specify either that markets for corporate control are just broken, preventing the takeover of less efficient firms by more efficient management, or that the firms are in sectors that are simply inherently less productive. Killing those firms allows the workers to shift over to alternative, more productive, employment. It sure doesn't seem a plausible model though.

Further, it can often be the case that lower skilled workers are complements to higher skilled workers. Here at Canterbury, a few years before the earthquakes, the University got rid of some of the cleaners and started making staff empty their own waste baskets into central bins on each floor of each Department.* It saved on some low cost workers' salaries, but at a higher and unmeasured opportunity cost. For every low productivity firm that's killed by Trotter's prescription, how many lower productivity tasks in higher productivity firms are also ended? What do we do with those whose endowment of human capital means that their marginal revenue product will never be higher than the current minimum wage?

* The veneer: sustainability, we should be throwing less stuff out, etc.

Tuesday, 23 October 2012

Stupid NZ Fixed Costs

Posted by

Eric Crampton

Tyler Cowen warned me that New Zealand would teach me about fixed costs.

Today's lessons: pens. Consequent to the new environment of heightened fiscal restraint at Canterbury, I have found that the Uniball Signo 207 pens I've preferred are $5 each via the University's preferred supplier.*

The same pens at Amazon are US$12.59 for a dozen with free shipping within the US. That's about $1.31 per pen. The cheapest online NZ price I've been able to find is $3. Freight brings it up to $3.50 - I'll leave GST off because Amazon doesn't charge it and because the University doesn't pay GST on business inputs. A $2.19 per pen NZ premium.

Prezoom charges $19.50 to on-ship a 500 gram package from the US. The pen weighs 10 grams, so a dozen comes in well under the 500 gram limit. So a dozen pens, that go from Amazon to Prezoom then on to me in NZ across the ocean arrives at my desk for $35.25; the same dozen shipped from New Zealand is $42. The hassles and delays are not worth $7. If I needed 50 pens, the most that would fit in the 500 gram pack, I'd save $90. But who needs 50 pens? And how many pens' weight would be in the packaging? Finally, the transactions costs of trying to convince University admin that it's worthwhile ordering case lots of pens in from the States seem insurmountable, especially if they already make it a hassle to try and use anybody other than the preferred supplier within NZ. [see update, below]

New Zealand... it's the little things that irritate. I'm not saying that NZ retailers are earning any kind of excess profit here: warehousing and logistics in a small country are just more expensive, and keeping any kind of inventory in a small market also just kills. It's simply an irritating fact of the world.

I'll tell you one thing though... next request to borrow a pen gets met with harsh words.

* UPDATE: that's the catalogue price. The departmental administrator tells me the University gets a pretty substantial discount against that price. It's still reasonably above the US price even counting shipping from the US, but below the cheapest online price. It's still cheaper to get a 50 pen lot shipped here from the States than to buy them from the University's preferred supplier.

Today's lessons: pens. Consequent to the new environment of heightened fiscal restraint at Canterbury, I have found that the Uniball Signo 207 pens I've preferred are $5 each via the University's preferred supplier.*

The same pens at Amazon are US$12.59 for a dozen with free shipping within the US. That's about $1.31 per pen. The cheapest online NZ price I've been able to find is $3. Freight brings it up to $3.50 - I'll leave GST off because Amazon doesn't charge it and because the University doesn't pay GST on business inputs. A $2.19 per pen NZ premium.

Prezoom charges $19.50 to on-ship a 500 gram package from the US. The pen weighs 10 grams, so a dozen comes in well under the 500 gram limit. So a dozen pens, that go from Amazon to Prezoom then on to me in NZ across the ocean arrives at my desk for $35.25; the same dozen shipped from New Zealand is $42. The hassles and delays are not worth $7. If I needed 50 pens, the most that would fit in the 500 gram pack, I'd save $90. But who needs 50 pens? And how many pens' weight would be in the packaging? Finally, the transactions costs of trying to convince University admin that it's worthwhile ordering case lots of pens in from the States seem insurmountable

New Zealand... it's the little things that irritate. I'm not saying that NZ retailers are earning any kind of excess profit here: warehousing and logistics in a small country are just more expensive, and keeping any kind of inventory in a small market also just kills. It's simply an irritating fact of the world.

I'll tell you one thing though... next request to borrow a pen gets met with harsh words.

* UPDATE: that's the catalogue price. The departmental administrator tells me the University gets a pretty substantial discount against that price. It's still reasonably above the US price even counting shipping from the US, but below the cheapest online price. It's still cheaper to get a 50 pen lot shipped here from the States than to buy them from the University's preferred supplier.

What if governments can't pay their debts?

Posted by

Eric Crampton

The 2012 Condliffe Memorial Lecture in Economics at Canterbury will be held on Wednesday, 5 December, as part of the University of Canterbury's ongoing "What If?" lecture series. This year, we're pleased to host Professor John Cochrane.

Here's the announcement:

Please RSVP via the University's website.

Update: The University's RSVP process is more than a little cumbersome. If you can't make it work for you, send me an email at eric.crampton@canterbury.ac.nz and I'll make sure you get on the list.

The Economics Department is particularly proud of its Condliffe Lecture series. Prior years' speakers include:

Here's the announcement:

Please RSVP via the University's website.

Update: The University's RSVP process is more than a little cumbersome. If you can't make it work for you, send me an email at eric.crampton@canterbury.ac.nz and I'll make sure you get on the list.

The Economics Department is particularly proud of its Condliffe Lecture series. Prior years' speakers include:

- 2005: Jerry Hausman: Consumer benefits from increased competition in shopping outlets: Measuring the effect of Wal-Mart.

- 2006: Gene Grossman: Trading tasks: It's not wine for cloth anymore.

- 2007: Mark Blaug: Congestion charges: the solution to traffic problems?

- 2008: Joel Slemrod: Tax policy in the real world

- 2009: Hal Varian: Computer-mediated transactions

- 2010: Charles Plott: The emergence of economics as a laboratory science

- 2011: Martin Weitzman: Why is the economics of climate change so difficult and controversial?

- 2012: John Cochrane: What if government's can't pay their debts?

- 2013: Ed Glaeser has accepted our invitation to be next year's Condliffe Memorial Lecturer. I'll hope that he'll be talking about his work on the economics of the city.

Sunday, 21 October 2012

Quirrell Points

Posted by

Eric Crampton

I continue to enjoy Harry Potter and the Methods of Rationality. Eliezer Yudkowsky there proposes a rather interesting pedagogic technique, via the excellent Professor Quirrell:

Alas, in our muggle world, we're constrained by normal physics and haven't access to magic.

First, I can't see how you could set up a self-scoring test that weren't multiple choice, true/false, or restricted to questions where you can have a numeric or algebraic solution. So that makes it a lot less appealing right from the start. There are some courses in economics for which this could work, just not the courses I'm teaching.

Second, the logistics wouldn't be pretty. Here's the best way I can imagine it working; maybe you can help me out if you're more imaginative.

In Phase One of the test, everyone would sit the test at a computer terminal. Each student is assigned a score for Phase One; the system's back-end also keeps track of competences across subcomponents.

After Phase One, students who did well on subcomponents are given the option to have their names released for tutorial assistance. Students who did poorly are told which students who did well on those subcomponents would be suitable tutors, along perhaps with some reputation score indicating how well they've performed in the past in improving others' grades.

The students who did poorly then are given the chance to sit Phase Two, in which they could re-do the parts they did badly for partial credit. The student assistants are given a part of the re-tested students' score improvement as bonus points.

There's a Muggle-world mechanism design hindrance: You need some way of ensuring that the system can tell which tutors helped which students. Tutors will have an incentive to disavow students who are likely to do poorly, to help keep their averages up. Some poorer students may try to claim a tutor relationship where one didn't exist to drag down the average of too-smug higher performing students like Ms. Granger. If tutors can't disavow students, they're blamed for the ones who didn't show up for the tutorial sessions. There's probably a way around the problem, but it doesn't seem easy. Even if you could sort it out, you'd need a way of programming it into the various online course management systems.

If I ever figure out a way of having online-only self-grading tests, I'd start thinking harder about these mechanism design issues.

"And on the rare occasions I offer you a written test, it will mark itself as you go along, and if you get too many related questions wrong, your test will show the names of students who got those questions right, and those students will be able to earn Quirrell points by helping you."If this could be set up, boy would it take a load off of the lecturer.

...wow. Why didn't the other professors use a system like that?

Alas, in our muggle world, we're constrained by normal physics and haven't access to magic.

First, I can't see how you could set up a self-scoring test that weren't multiple choice, true/false, or restricted to questions where you can have a numeric or algebraic solution. So that makes it a lot less appealing right from the start. There are some courses in economics for which this could work, just not the courses I'm teaching.

Second, the logistics wouldn't be pretty. Here's the best way I can imagine it working; maybe you can help me out if you're more imaginative.

In Phase One of the test, everyone would sit the test at a computer terminal. Each student is assigned a score for Phase One; the system's back-end also keeps track of competences across subcomponents.

After Phase One, students who did well on subcomponents are given the option to have their names released for tutorial assistance. Students who did poorly are told which students who did well on those subcomponents would be suitable tutors, along perhaps with some reputation score indicating how well they've performed in the past in improving others' grades.

The students who did poorly then are given the chance to sit Phase Two, in which they could re-do the parts they did badly for partial credit. The student assistants are given a part of the re-tested students' score improvement as bonus points.

There's a Muggle-world mechanism design hindrance: You need some way of ensuring that the system can tell which tutors helped which students. Tutors will have an incentive to disavow students who are likely to do poorly, to help keep their averages up. Some poorer students may try to claim a tutor relationship where one didn't exist to drag down the average of too-smug higher performing students like Ms. Granger. If tutors can't disavow students, they're blamed for the ones who didn't show up for the tutorial sessions. There's probably a way around the problem, but it doesn't seem easy. Even if you could sort it out, you'd need a way of programming it into the various online course management systems.

If I ever figure out a way of having online-only self-grading tests, I'd start thinking harder about these mechanism design issues.

Saturday, 20 October 2012

So far so good

Posted by

Eric Crampton

Experiences at the tails of the distribution tend to get disproportionate weight because they're usually the stories worth telling. So here's my boring EQC story for balance.

After the September 2010 earthquakes, we saw an EQC adjuster (sometime early December) who said our house needed a new coat of paint inside and tightening up the weather boards outside. That seemed about right; we weren't in any big rush to get anything done.

After February 2011, we didn't see an EQC adjuster until June. The damage was far more substantial; the adjuster noted that the foundation and piles need re-levelling in addition to more substantial internal fixes. We made arrangements with Character Homes to handle our rebuild. The EQC procedures around specifying your own contractor rather than going with the one assigned by Fletcher's Project Management changed a few times. But, by July 2012, we had a Scope of Works document from EQC that would allow us to take the next step and have our contractor check whether EQC's specified Scope of Works seemed to match the job that needed to be done. We submitted Character Homes's revised Scope of Works in August 2012.

On 18 October, the EQC adjuster and Guy from Character Homes showed up at our place, went through the two Scope of Works documents, and agreed on the stuff that needed doing and how much it was likely to cost. Everything went pretty smoothly. In three or four weeks we're likely to get the works order from EQC that will let us sort out with our contractor when the work will be done; we're likely to be out of our house for 4-6 weeks' worth of repairs sometime between December and April. Our contractor seems pretty flexible on dates so we'll time things to match when we can find suitable rental accommodation, which ain't exactly easy in Christchurch these days. We'll have to empty the house as if we're moving out, so we'll have to sort out a couple of shipping containers and a place to put them. But, we should be able to get it done over the summer when I'm not teaching and the costs of disruption are lower.

EQC tells me we're likely to see an adjuster come by sometime in the next six months to a year to look at the land: there's a retaining wall that needs repairing. Our private insurer, AMI/Southern Response, tells us they'll be around sometime in the next couple of years to sort out our out-of-scope claims. What's out-of-scope? Things that aren't covered by EQC: a fence, some paths, and our swimming pool, the lining of which twisted and the bottom of which is now awfully uneven. I expect that if it takes two years to assess the damage to the pool liner, it's going to be in need of total replacement rather than minor repair: its having pulled away from the pool in a few spots isn't good for longevity, but that doesn't seem to be hurrying Southern Response. But at least they started answering my emails in the last month.

So, 20 months after the big quakes, it looks like our main repairs will be handled sometime in the next four months. It's taken a while to get there, but doing it earlier likely wouldn't have been a great idea - substantial risks of large aftershocks have only recently abated. Our house is comfortable and liveable while we await repairs. Filling the gaps between weatherboards before next winter should reduce our heating costs a bit.

Experiences vary considerably. Bill's not been having a great time. It's more confusing if you're in TC3 rather than TC2. The folks in Avoca Valley seem to have been being shafted. And we should put a lot of weight on the experiences of those most badly put upon by the bureaucracy. But not everywhere is doom.

I do hope they get moving on buying up, demolishing, and turning to parkland the houses around Bexley. The commute home through there gets more depressing every day as abandoned homes become burned-out houses, or graffiti-tagged and broken-windowed. Obligatory note for potential international students at Canterbury: Bexley is a half-hour away from Uni on the East side of town. Nothing like that on the West side near campus.

After the September 2010 earthquakes, we saw an EQC adjuster (sometime early December) who said our house needed a new coat of paint inside and tightening up the weather boards outside. That seemed about right; we weren't in any big rush to get anything done.

After February 2011, we didn't see an EQC adjuster until June. The damage was far more substantial; the adjuster noted that the foundation and piles need re-levelling in addition to more substantial internal fixes. We made arrangements with Character Homes to handle our rebuild. The EQC procedures around specifying your own contractor rather than going with the one assigned by Fletcher's Project Management changed a few times. But, by July 2012, we had a Scope of Works document from EQC that would allow us to take the next step and have our contractor check whether EQC's specified Scope of Works seemed to match the job that needed to be done. We submitted Character Homes's revised Scope of Works in August 2012.

On 18 October, the EQC adjuster and Guy from Character Homes showed up at our place, went through the two Scope of Works documents, and agreed on the stuff that needed doing and how much it was likely to cost. Everything went pretty smoothly. In three or four weeks we're likely to get the works order from EQC that will let us sort out with our contractor when the work will be done; we're likely to be out of our house for 4-6 weeks' worth of repairs sometime between December and April. Our contractor seems pretty flexible on dates so we'll time things to match when we can find suitable rental accommodation, which ain't exactly easy in Christchurch these days. We'll have to empty the house as if we're moving out, so we'll have to sort out a couple of shipping containers and a place to put them. But, we should be able to get it done over the summer when I'm not teaching and the costs of disruption are lower.

EQC tells me we're likely to see an adjuster come by sometime in the next six months to a year to look at the land: there's a retaining wall that needs repairing. Our private insurer, AMI/Southern Response, tells us they'll be around sometime in the next couple of years to sort out our out-of-scope claims. What's out-of-scope? Things that aren't covered by EQC: a fence, some paths, and our swimming pool, the lining of which twisted and the bottom of which is now awfully uneven. I expect that if it takes two years to assess the damage to the pool liner, it's going to be in need of total replacement rather than minor repair: its having pulled away from the pool in a few spots isn't good for longevity, but that doesn't seem to be hurrying Southern Response. But at least they started answering my emails in the last month.

So, 20 months after the big quakes, it looks like our main repairs will be handled sometime in the next four months. It's taken a while to get there, but doing it earlier likely wouldn't have been a great idea - substantial risks of large aftershocks have only recently abated. Our house is comfortable and liveable while we await repairs. Filling the gaps between weatherboards before next winter should reduce our heating costs a bit.

Experiences vary considerably. Bill's not been having a great time. It's more confusing if you're in TC3 rather than TC2. The folks in Avoca Valley seem to have been being shafted. And we should put a lot of weight on the experiences of those most badly put upon by the bureaucracy. But not everywhere is doom.

I do hope they get moving on buying up, demolishing, and turning to parkland the houses around Bexley. The commute home through there gets more depressing every day as abandoned homes become burned-out houses, or graffiti-tagged and broken-windowed. Obligatory note for potential international students at Canterbury: Bexley is a half-hour away from Uni on the East side of town. Nothing like that on the West side near campus.

Friday, 19 October 2012

Local Workers First

Posted by

Seamus Hogan

Labour leader, David Shearer, wants to bring in rules making it harder for employers to bring in migrant workers without having first explored all possibilities for hiring New Zealand workers.

Let's leave aside the moral question of whether non-New Zealanders should be included in the government's welfare function, and just accept, morally repugnant though that view may be, that most voters probably think that New Zealand policy should care only about New Zealand residents. Even with that welfare criterion, there are a couple of problematic things in Labour's proposed policy.

First, according to the article, Mr Shearer wants to use government procurement as a branch of social policy: