Sometimes, Richard Harman's Politik newsletter gets things right.

Today, not so much.

Loyal readers may have noticed that opening New Zealand up to real supermarket competition has been something of a priority for us.

It isn't new.

Oliver was writing on the importance of land use planning as barrier to competition as early as 2014.

I'd noted it in 2019, here, I think before the market study into groceries was even announced (but I'd have to check back on the timing). I was then urging ComCom to use its new market studies powers to go after the real darned cartel enforcement: land use planning rules, and other regulations that prevent entry.

If private cartels had ever worked to comparable effect, there would be deserved public clamour for the jailing of those responsible under the recent amendments to the Commerce Act, consequent to investigation of the cartel under a Commerce Act Part 3A market study.

But can you even imagine the Commerce Commission setting Part 3A investigation of the extent to which the state is responsible for any of the country’s anticompetitive ills?

It is not hard to come up with a list of places to look.

For example, what are the combined effects of New Zealand’s building materials certification regime when combined with council incentives under joint-and-several liability? Is there any good reason that it would be rather difficult to import and use building materials from trustworthy, comparable places like Vancouver, Seattle or Tokyo?

What are the effects of zoning on substantial competition in retailing? Is it even possible for any new larger-footprint retail players to emerge given existing zoning restrictions? Isn’t the simplest explanation for decades of minimum parking rules that those rules raised the cost of entry for potential competitors?

We regularly hear complaint about lack of competition in banking and insurance, but nobody seems particularly keen on looking seriously at the legislative and regulatory barriers that would face new entrants. If there are large excess profits to be had in serving the New Zealand market, why is no one picking up those twenty-dollar bills sitting on the sidewalk?

I want real antitrust enforcement going after the country's real villains: the bureaucrats in central and local government who protect insiders, and who deserve to be in jail for it, but are protected by Section 3A Part 43 of the Commerce Act. Statutory regimes are given a pass. Bureaucracy protects itself.

Market Studies give the only real way of digging through to the villainy of those regimes. They can take a broad look at conditions affecting competition. And in some cases, it's damned hard to avoid seeing what's going on.

ComCom's draft report tried to ignore it. Chapter 6 of the draft report mentioned it, but punted, claiming that RM reform was in progress and was somebody else's problem.

So we went in hammer and tongs. Submissions, columns, media - wherever I could find a spot to yell about the need to open up land use planning and the overseas investment act to enable real entry, I took it. There aren't many times when there seems to be a real chance of changing an outcome, rather than just putting up the analysis for a future better government to pick up, or informing the public about the policy options.

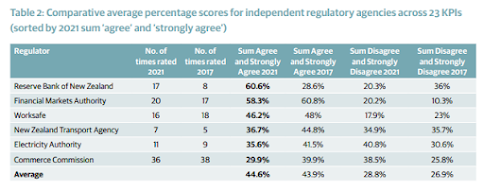

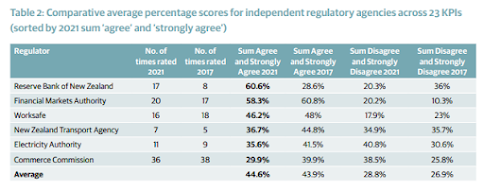

At the same time in 2021, our Chair, Roger Partridge, was putting together an updated version of the survey he'd run a few years previously on businesses' views of the regulators they deal with. In the first survey, RBNZ came out poorly. They made governance changes, including a Board structure. I've been not at all a fan of how they've been running monetary policy, or the emphasis on climate instead of inflation, but RBNZ also does a ton of regulatory oversight with banks and insurers.

The survey asked each of a couple hundred businesses to assess the regulators that they deal with most often. [Update: we got about a hundred responses.] Each one answered a couple dozen questions about the regulator that they deal with most often, second-most often, and third-most often. A lot of regulators get covered; different industries deal with different regulators.

The Commerce Commission drew the most ratings - in part because it's in three parts. There's the Competition and Consumer Branch, the Price Regulation Branch, and the Telecommunications Commissioner.

I don't think anybody provided a rating for the Transport Accident Investigation Commission or Heritage New Zealand or the New Zealand Walking Access Commission. Remember that they get a rating if they're among the three regulators with whom a business interacts. A business would have to be pretty messed up if one of its top-three interactions were with the Transport Accident Investigation Commission.

Anyway, Roger made me do the spreadsheet work for the survey. I do not enjoy it. The data needs a lot of cleaning to be usable. And I do not like data cleaning. It is a terrible use of my time but we're a small shop and somebody has to do it.

So I compiled things in the spreadsheet and gave the numbers back to Roger. The only times I even looked at the names of the regulators was to make sure I was matching things properly.

ComCom came out poorly this time. The numbers are what they are. I don't care what the numbers are. I just care that I don't screw things up in the spreadsheet.

Roger's report came out a couple of weeks ago.

And that led Richard Harman to spin an incoherent conspiracy theory.

Here's what he wrote in his newsletter this morning. I haven't corrected his typos. I have put in a few comments along the way.

Discrediting the Commerce Commission’s supermarket competition report

By Richard Harman -03/06/2022

That the Minister of Commerce and Consumer Affairs, David Clark, yesterday chose his words carefully when he commented on the attempts to bring more competition to the supermarket sector says a lot.

Clark told POLITIK that the supermarkets were reacting “in public” positively to what the Government was proposing.

But away from the spotlight, a critical ally of the supermarket companies was mounting a full-on critique of the Commerce Commission and its Market Study into the retail grocery sector.

The Commission identified two main areas where it considered consider changes would be desirable “to help facilitate an increase in the number of grocery retailers that compete effectively with the major grocery retailers”

One was to improve the availability of a wide range of wholesale groceries on reasonable terms.

“We consider that retail competition would be enhanced by one or more of the major grocery retailers offering wholesale supply of groceries to other retailers on a voluntary basis,” the Commission said.

The other proposal was to take measures to make more sites available for grocery retailing. “We recommend using a range of mechanisms under planning law to ensure sufficient land is available to enable choice in sites for new retail grocery stores,” the Commission said.

“We also recommend prohibiting the use of restrictive covenants on land and exclusivity covenants in leases.”

On Budget night Clark introduced the Commerce (Grocery Sector Covenants) Amendment Bill which ammended to, ban restrictive covenants on land, and exclusive covenants on leases.

It also made existing covenants unenforceable. “This legislation stops supermarkets from engaging in the anti-competitive land wars we’ve seen, where they buy up land or dictate the terms of leases to block their competitors from getting a foothold in the area,” said Clark.

Perhaps surprisingly, both supermarket chains, Foodstuffs and Countdown, have supported the legislation in submissions to the Economic Development, Science and Innovation Committee.

Foodstuffs North Island CEO Chris Quin said the Bill was consistent with the company’s “Action Plan” which it had developed in response to the Commerce Commission.

But a submission to the Committee from Food and Grocery Council CEO, Katherine Rich, suggested that the companies were able to support the Bill because they actually had much more draconian controls on who might set up shop near a supermarket inserted in the highly confidential lease agreements they entered into with landlords.

Those controls are effectively secret and unlikely to be able to be touched by Clark’s Bill in the form it was introduced into Parliament. “What’s become apparent through our review of a generic retail lease is supermarkets aren’t using their market power to block not just fellow grocery retailers – they’re using it to block or constrain almost all retail that comes close to them,” Rich told the Committee yesterday.

“This is done by using incredibly broad definitions of what a supermarket is in leases that describe their sphere of interest.

“In summary, anything that can be sold.

“It’s an exhaustive list.

“The supermarket has defined its business as almost everything that can be sold by anybody.

“The supermarket can add any other goods at any time to futureproof opportunities or threats — all rights are reserved.

“Most New Zealanders would not think a supermarket is something that sells clothing, fashion, luggage, sports and fitness goods, appliances, shoes, computers, insurance and lending, hair dressing services, banking, arts and crafts or childcare services.

“But according to this lease, they do.”

Rich said supermarkets also gave themselves the rights to determine who the landlord leased to up to 3 years after the supermarket has vacated the property.

“But the clause that surprised us the most was the requirement for landlords to campaign to block potential supermarket competition.

“The lease we’ve quoted demands that the landlord make submissions to oppose all district plans, developments, new stores, applications for resource consent, or changes to a resource consent that affects the supermarket’s competitive position at the landlord’s own cost.

“All these sorts of oppressive clauses add up to barriers for new entrants.”

The supermarkets have an influential ally in the New Zealand Initiative, the right wing think tank which is a successor to the Business Round Table.

Both supermarket companies help fund the Initiative.

Our first submission to ComCom highlighted the importance of barriers to entry. We noted that it may be practically impossible to open a new supermarket chain. Zoning sets very few sites that are allowed to be supermarkets; many sites that are allowed to be supermarkets by zoning are tied up in restrictive covenants; consenting can take years or a decade; and, you have to get through the Overseas Investment Office.

Our second submission, after the consultation rounds and hearings, made the point again. Look through the covenants, void any that are found to be anticompetitive in effect. Look too at lease arrangements but remember that there can be good efficiency reasons for exclusivity in leases. But first and foremost fix zoning. None of the rest can matter if people are allowed to set up supermarkets everywhere. It would be impossible to encumber the whole city against being a supermarket. It's only possible for encumbrances to matter if zoning is stupidly tight to begin with.

Just over a week ago in a report written by its chair, Roger Partridge, it reported on a survey of the country’s 200 largest businesses by revenue, “together with those members of The New Zealand Initiative not otherwise included in the top 200.

Just 36 companies responded when asked to rate the Commerce Commission which was ranked as the least effective of six regulatory agencies.

Despite the very low response, the Initiative pumped out press releases and videos with titles like: “Time is up for the Commerce Commission”; “Reform needed as Commerce Commission suffers alarming slide in regulatory performance”; “Roger Partridge on new research that shows businesses are losing faith in the Commerce Commission.”

I wonder whether Harman read the report, or whether Clark just fed him the line. Here's Table 2 of the report. ComCom was the most frequently rated agency.

If Harman read the report and came to this conclusion, he's past-due for retirement. If he was just fed the line by Clark and repeated it, same thing.

Again: each of the 200+ were asked to provide ratings for the top three regulators they deal with. Not all of the 200 are going to primarily be dealing with ComCom. It would be stupid to expect that they would. Different companies deal with different regulators. We didn't want rankings of regulators that a company only deals with infrequently. We wanted rankings from companies who had those regulators front-of-mind.

Back to Harman:

In a podcast a week ago, the Initiative’s Executive Director, Oliver Hartwich, took up the issue of the Initiative’s report.

“What came through in our survey was that many large companies actually believed that the Commerce Commission simply didn’t understand the market conditions in which they operate, that they lacked some commercial expertise,” he said.

Also on the podcast was Foodstuffs director, Peter Schultz who agreed that the Commerce Commission lacked expertise.

“From my perspective, the depth of knowledge that participants in an industry sector have relative to a group working in the commission; the difference is huge,” he said.

“So there’s got to be a great learning curve that’s required through the process.” Hartwich repeated the message; that the Commerce Commission lacked the expertise to conduct the supermarket market survey.

“What I just heard from you, it took you the better part of a year to get the Commerce Commission up to speed on how supermarkets work and how the industry works,” he said.

I was in on that podcast chat. I noted that the draft report was incompetent, but that the final report was much improved. I was rather happy with the final report. The importance of regulatory barriers to entry seemed to finally have clicked for them. I said as much in the podcast.

I just don't get Harman. Given that the final report from ComCom actually got it right, and we'd put out supportive press releases about the damned thing, would we have been trying to undermine ComCom in the supermarkets inquiry by releasing the report? Like, how stupid would that be? ComCom finally got it right, Clark had gone off on a populist tear claiming that supermarkets cause inflation rather than monetary policy and saying he'd do a pile of crazy stuff that the Commission had recommended against.

If we had been playing dodgy games, we would have delayed the release of the report until after the government had completed its response to the Market Study. The last thing we'd want to be doing would be undermining ComCom relative to Minister Clark's populist hunches and others' rent-seeking.

But we don't play those games. The report was ready so we released it. I was annoyed that the numbers had come out poorly for ComCom given that their final report had gotten to the right spot, but the numbers are what they are.

Clark told POLITIK that he was getting very positive support from the public for the moves he ahd already announced to strenghten competition.

“I think New Zealanders understand that there’s a major issue that needs tackling and they’re really pleased to see strong, decisive action from the Government,” he said.

But what about the supermarket companies?

“I have to say at this stage that the public comments are very much in favour of increasing competition in the market.

“They certainly don’t want to get offside with consumers, so they will continue to pitch their own offerings.

“But at this stage they appear to be open to change.”

Clark’s reference to “public comments” is a hint that behind the scenes the supermarkets are playing hardball.

The role of the New Zealand Initiative as what appears to be a proxy critic of the Commerce Commission with presumably the intention that will discredit its report is obvious.

Why on earth would we be trying to do that, when ComCom's final report got the big picture thing right?

But Rich believes that one of the keys to unlocking competition is to get rid of the secret lease clauses.

“Our main message is that it’s not just a single exclusivity clause, it’s a suite of oppressive clauses that have the same effect,” she said.

“And in particular, you should certainly prohibit the ability for a supermarket to tell a landlord or anybody to go out and campaign against new developments in district plans and that sort of thing.”

“If this committee gets its definitions in this bill right then you will increase competition not just in grocery retail, but in all retail, due to these incredibly broad definitions being used to block others.

“You might even see a return of more Mum and Dad retail.”

I do not believe that there is anyone in the entire country who has put more effort into making the case for ending the regulatory barriers to entry that prevent effective supermarket competition.

I also do not believe that the ComCom final report would have figured this out if I hadn't done the work.

Richard Harman perhaps should consider retirement.