Over at the Public Health Blog, Nick Wilson runs some numbers on the likely effects of the tobacco tax hikes.

Our BODE3 Programme Team have developed and published on a tobacco forecasting model (4,5). Running this model for the newly proposed programme of increasing tobacco tax by 10% each year until 2020 will see tobacco smoking prevalence reduce to 21.4% for Māori and to 8.9% for non-Māori by 2020 (compared to 22.7% and 9.3% if this taxation programme had not continued beyond January 2016 – see Figure 1). Assuming a continuation of ‘business-as-usual’ patterns in smoking uptake and cessation thereafter, the model suggests that prevalence will further reduce to 17.3% and 7.2% by 2025 for Māori and non-Māori respectively. Furthermore, the additional four rounds of tax increases have the potential to reduce the absolute ethnic gap in smoking prevalence observed in this country by nearly 1 percentage point in 2020 (ie, from 13.4% to 12.5%). In reality however, we suspect that annual tax increases are now so well accepted by NZ politicians and the public that this programme would actually be extended beyond 2020 when this year is reached.

I’m not going to dispute these figures at all; they line up with the ballpark figures I keep in my head on things – or at least through 2020. The price elasticity of demand for alcohol is about -0.4; the participation elasticity of smoking is about -0.2 or -0.25. The numbers here through 2020 are definitely in the ballpark I’d expect from a 40% increase in excise where excise starts at about 60% of the current price of a pack of smokes. The numbers through 2025 would be tougher to attribute to excise as more of the work there is being done by the continued decline in youth smoking uptake which would happen regardless of tax, and Wilson does not provide the counterfactual “what smoking in 2025 would be absent the tax” number (though the gap between the curves in 2020 isn’t much different from the gap between the curves in 2025).

But let’s think through what they mean.

By 2020, Wilson projects that excise will have cut smoking rates among Maori from the 22.7% he would have otherwise expected to 21.4%. So for every 1000 Maori in 2020, 13 who would otherwise have been smokers will not be smokers because of excise. That’s good for them, presuming that they wanted to quit and are happy that excise helped them to do so – which we’ll grant for now.

On the flipside, for every 1000 Maori, you have 214 smokers who will be paying a lot more for their cigarettes than they otherwise would have been paying.

The 2015 excise rate is $668.51 per 1000 cigarettes, or $13.37 per pack of 20 cigarettes. Suppose each smoker smokes a half a pack a day: 10 cigarettes. Each is then currently paying $2440 in tax per year. Does that number seem very high when smokers are heavily concentrated among the poorest? It should give you a bit of pause.

That tax is scheduled to increase now by 10% per year for four years: a 46.4% increase (assuming it compounds). The tax rate per thousand cigarettes would then be $978.70, and the annual excise on a half-pack-a-day habit would be $3572.25.

We should not expect that smokers would maintain current levels of consumption if prices increase. If we go with a standardish price elasticity of demand of -0.4,* and if the cheapest cigarettes currently are $18.80 for a pack of 20 Easy brand, and if we assume 100% excise pass through to get the biggest cuts in consumption possible (unrealistic), then the price of that pack of 20 will increase to $25. A 46.4% excise hike results in a 33% increase in the actual price of cigarettes (as about $5 of an $18.80 pack is the tobacco currently). Each smoker would then cut consumption by about 13%, so a 10 cigarette a day habit would drop to 8.7 cigarettes. Let’s round to 9 when we recognise that some people do smoke more expensive brands currently and will save money by shifting to a lower price point.

So for every 1000 Maori, we have:

- 773 who would not have smoked regardless,

- 13 who quit because of the tax and enjoy health benefits, save some money, and may or may not be happier from having quit – we’ll assume happier,

- 214 who keep smoking about 90% as much as they had been smoking. Each and each pay about $1020 more in excise per year than they otherwise would have paid.

For every Maori smoker who quits, 16.46 Maori smokers will pay a bit over a thousand dollars more in excise per year – assuming they start with a half-pack-a-day habit. Some will pay more, some less. The 2014/2015 NZ Health Survey says that Maori daily smokers smoke on average 10.3 cigarettes per day, so that’s about right. On the other side, the same survey says that current prevalence of daily smoking is 35.5% among Maori. If Wilson’s figures underestimate baseline smoking in 2020, then the tax hike would have a few more current smokers quitting than here estimated, and a lot more current smokers paying that extra thousand bucks per year.

The NZ Health Survey notes that daily smoking rates are 25.4% overall in the most deprived neighbourhood quintile (as compared to 8.3% in the least deprived quintile). MoH estimates there are 178,000 daily smokers in the most deprived quintile. If each of them is pays an extra $1000 in tax, the government is pulling $178 million more dollars out of our poorest communities.

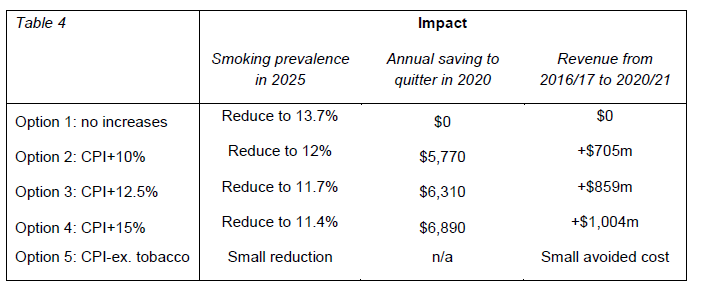

Earlier this week, Jenesa went through the numbers starting instead from the Regulatory Impact Statement.

The government expects another $700 million out of this.

There are currently 546,000 daily smokers, or at least by the 2014/15 latest figures. Some will quit. The government expects to get $1282 per current daily smoker (or $1157 per smoker including intermittent smokers). Since some will quit, the burden per non-quitter, on these estimates, suggest my figures above understate the true figures – assuming Treasury’s done a more careful job of things than my spitballing out of Nick Wilson’s numbers.

We can pretty confidently state that smokers who continue, which will be the vast majority of smokers, will be paying over a thousand dollars more per year for their habit, and that these smokers are heavily disproportionately poor.

The quintile household income boundary for the bottom quintile in 2014 was $21,300.** If a bottom quintile household has one smoker in it, $1000 per year is 4.7% of that household’s annual income. That’s an overestimate of the effect in 2020, because incomes in the bottom quintile will have increased by then. If we extrapolate the average annual increase in that quintile’s real income since 2001 through to 2020 from 2014, income would be about $23,285, and the $1000 in excise increase would be 4.3% of that household’s annual income. But remember that this is just the increase in excise. The total burden of tobacco excise on a bottom quintile household’s income where that household has one smoker on a half-pack a day is about 13.8%.

Meanwhile, it remains illegal to sell nicotine-containing vaping cartridges in New Zealand. You might think that if health policy were about health, rather than about loading taxes onto marginalised and politically weak groups, we’d have had an announcement about legalising vaping rather than pulling $1000 more per year out of poor smokers.

The greatest*** trick the devil ever pulled was convincing people that tobacco excise is good for the poor because the health benefits are progressive. You can get those same progressive health benefits simply by legalising vaping, without the ridiculous regressive burden. Where even this massive tobacco excise hike only has trivial effects on quit rates relative to the counterfactual, and huge effects on household incomes for the poor, vaping doesn’t have to achieve all that high a penetration rate to be far far more effective than excise.

Another fun fact: where benefits tend to be CPI adjusted, they use CPI not inclusive of tobacco prices.

I wanted to run some of these numbers because I’m heading this afternoon into a pre-record for Radio New Zealand’s Sunday Morning programme. Along with me will be the excellent Marewa Glover, and Tony Blakely. Tune in on Sunday….

* A -0.5 figure is often used for consumption, but I’ve already accounted for participation elasticity, so I think I’m being conservative here.

*** Ok, among the greatest.

No comments:

Post a Comment