A few months ago, RBNZ and Treasury made some pretty extraordinary claims about the appointment process for external members of the Monetary Policy Committee.

Treasury had, in notes released under OIA, said that academic economists with an ongoing research interest in the area were considered conflicted for the MPC.

Michael Reddell's written a lot more on it than I have, but it's something that worried us too. I had a column in the Herald on the problem, which included a survey that me and Dennis Wesselbaum ran of the country's macroeconomists on the next round of MPC appointments / reappointments.

And it came up when I had a podcast with John Cochrane.

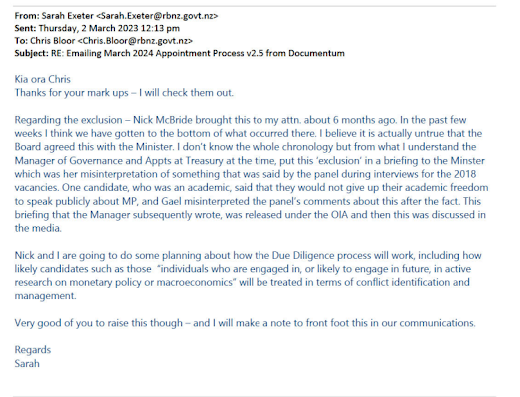

More recently, RBNZ told Treasury that it had all been a big misunderstanding on Treasury's part and that there had never been such a blackballing. And Treasury officials seemed to just take it at face value rather than contest it and pick a fight with the Minister of Finance and RBNZ about it.

Michael and I both separately sent through some OIAs trying to figure out just what the hell had happened. RBNZ repeatedly had made statements defending the blackballing, or consistent with there being a blackballing. It's great that there isn't a blackballing now, but memory-holing a prior one wouldn't be great.

I received a reply from RBNZ earlier this week and passed it on to Michael because he's been watching the file more closely. Michael has the replies I received, along with his own, up at Croaking Cassandra now.

I keep trying to come up with a fog-of-war version that has nobody involved just outright lying.

From the OIAs, it seems clear that Orr believed there had been a ban and was trying to figure out why there was one, since there didn’t seem to need to be one.

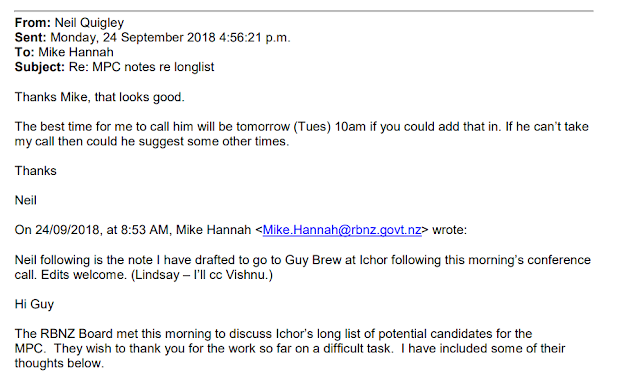

In February, in response to queries from Jenée Tibshraeny, officials punted on it by saying "criteria unchanged" - so they didn't have to commit to what the underlying criteria were. So senior levels in the Bank didn't seem to know what had happened during the 2018 appointment round but everyone there seems to have believed that there had been a ban.And nobody involved there dropped a note to RBNZ Chair Neil Quigley asking about it, where he seems to have headed up the appointment process.

Prof Quigley says there was no blackballing in 2018, despite the Governor having thought that there had been.

And then this account of what might have happened.

- Only appointment committee knew what happened; Governor's team were not in the loop.

- One candidate was blackballed as conflicted, and Treasury interpreted that as being a broader thing.

- All of RBNZ who weren't in on that appointment process take their lead from the early OIAed excerpt from Treasury's notes, which said academics with a research interest were conflicted.

- Quigley figures that the noise from the usual malcontents (me, Reddell, Wesselbaum, others) is just noise from the usual malcontents and pays it no mind.

- Orr doesn't bother asking his Chair about the prior appointment process when he has his team checking whether there's any reason they'd have to be blackballing appointees. This may be the least plausible link in the chain here?

- Where RBNZ has been pretty quick to put critics straight in other cases, they didn't here because they thought, mistakenly, that there had been a general blackballing - and all of it was below Quigley's threshold of attention.

- Robertson's 2019 comments were specific to an academic who did not want to forego free public commentary on monetary policy, rather than academics with a research interest more generally.

- Quigley finally notices and says there hadn't been a blackballing.

There was never a general blackballing, just a ruling out of one particular academic and a general expectation that academic researchers active in the Bank's areas would likely be conflicted. Which led to Treasury mistakenly viewing it as ruling out perhaps rare cases that might not be considered conflicted, and all senior tiers at RBNZ relying on Treasury's notes and believing for years that there was, in fact, a general blackballing when there wasn't and never had been.

No comments:

Post a Comment