Of course it’s a serious problem.

At BEFU 2019, Treasury forecast that the government’s policy programme would have Core Crown tax revenue and Core Crown expenses at 28.8% of GDP in 2023.

At BEFU 2023, Treasury forecast that the actual 2023 figures would be Core Crown tax revenue at 29.3% of GDP and Core Crown expenses at 32.5% of GDP.

PREFU will very likely show a worse track for tax revenue (weakening corporate tax take; weakening GDP forecasts in part on milk prices; finally correcting the error that Treasury made at BEFU in tobacco excise forecasting) but, in the absence of signaled policy changes, a worsening track for expenditures. GDP will be lower than forecast so the denominator gets lower. A worsening economy means more spending on the automatic bits that kick in: benefit payments, hardship grants and the like. So the numerator’s going to be higher.

I haven’t checked Westpac’s numbers but haven’t reason to second-guess them.

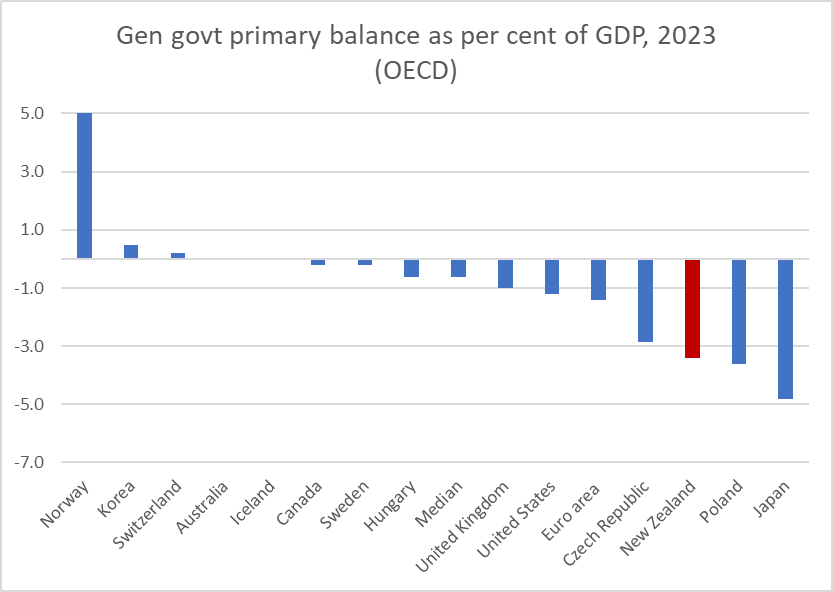

If we compare what Labour’s policy package had lined up, as of 2019, for 2023, it’s obvious that the problem isn’t on the revenue side. Revenue is up on the 2019 forecast. It’s spending that’s blown out. Debt and spending had to be part of the Covid response. But Michael Reddell’s shown that NZ’s fiscal response has been huge compared to other countries.

I’ve copied two of Michael’s charts below.

NZ started with a low net debt to GDP ratio. And still has a relatively low net debt to GDP ratio. But our increase in net debt was very large as compared to other countries, and the current general government primary balance is awful. Deficits that large might make sense in a recession, when tax revenues are down and spending on benefits is high. But doing this while the Reserve Bank is meant to be trying to get inflation back down is simply irresponsible.

The OBEGAL path presented at BEFU was not credible.

Treasury forgot that the government passed legislation banning the sale of cigarettes with nicotine in them from 1 April 2025; it projected a tobacco excise path that did not change with what amounts to tobacco prohibition. Recall that tobacco excise revenues are on the order of $1.7-$1.8 billion per year, and that the government’s projected surplus for 2026 was on the order of $0.6 billion. The VLNC rules bring forward the sharp drop in tobacco excise revenues that would otherwise have been expected further down the track. Annual tobacco excise revenues after 2026 are likely to be about a billion dollars lower than had been forecast at BEFU, on this single item, unless an incoming government eases the VLNC rules.

At the same time, large spending items like the food in schools programme were forecast to end at the end of 2024. It may be politically challenging for any incoming government to end that spending line in 2024. Treasury has to forecast based on what the government has legislated (barring its amnesia about the effect of tobacco prohibition on tobacco excise revenue). But expenditure paths that depend on decisions that are unlikely to be made may not be all that credible.

On the revenue side, inflation’s pressure on household after-tax disposable income is becoming intolerable. Had the income tax brackets been inflation-adjusted to 2017 levels, the median wage and salary earner’s after-tax income would be almost $1600 higher this year. Inflation-indexing only the bottom tax bracket would give $210 to everyone earning at least $17,000, and even the Job-Seeker benefit is now above that level. Coincidentally, that’s about as much as the government thinks its GST move on fruit and vegetables might save the average household.

At some point, the tax brackets will have to adjust to account for inflation. Failure to do so means more and more people on lower incomes wind up in higher tax brackets. But when it happens, tax revenue will drop.

Monday, 28 August 2023

Deficits and PREFU

Thursday, 24 August 2023

Vaping panic

I hate election campaigns.

- Labour proposes capping the number of vape shops at 600 - the same as the number of licensed tobacco shops when that legislation comes into effect. I had a chat with Phil Barry about the coming smoking rules; it's going to be a mess. But making it simultaneously harder to access vapes will make it even less likely that the new tobacco rules result in people shifting to vape. Excellent that RNZ goes to Action on Smoking and Health's Ben Youdan on it at least.

- ACT's mused about restricting vape sales to shops with a liquor licence. If Seymour meant that it'd be easy to get spirits at the local dairy, that'd be great, but....

- The public health people are counting the number of vape shops within 400m of schools. But schools tend to be near town centres. If a vape shop is around a city village centre, it's likely to be within 400m of a school. They're also worried about that those shops tend to be in lower-rent areas. But vape shops pop up in spots where rent is low. And that's also where smokers are - the potential client base. You might as well count dollar stores within 400m of schools. The map's here.

- The advocacy group for dairies that sell vapes put up a report. Recall that it's forbidden for a vape retailer to sell to under-18s. There are enforcement stings checking compliance. In the second half of 2022, there were 150 covert visits to vape shops (within general retailers) and 245 covert visits to tobacco shops (within general retailers). They found 89% compliance in vape shops and 94% compliance in tobacco shops. It suggests better enforcement of penalties for noncompliance could be in order, but also that they're within ballpark of each other. For the first quarter of 2023, it was 97% compliance for vape and 100% compliance for tobacco. It all suggests social supply is the more important route for kids getting vape; if government wanted to worry about that, it could mirror the rules around social supply of alcohol.

Wednesday, 23 August 2023

Morning roundup

The morning's worthies:

- NZ alcohol policy basically gives a veto over licensing to the Medical Officer of Health and to the Police. Sucks when you get a prohibitionist in charge of either. And why are so many NZ prohibitionists named Palmer anyway?

- Josh Gans on copyright status of AI-created works.

- Grimes set up an AI trained on her own work. It tweets. Grimes notes, "The degree to which this bot has mastered my internal monologue is terrifying to me"

- Michael Reddell on RBNZ forecasting. I think it's a damned shame we didn't get NGDP markets for NZ; Simon Bridges murdering iPredict may have cost us considerably. Thanks again Simon.

- A reminder that it was Don Lavoie who coined the term "knowledge problem" for Hayek's fundamental insight, not Hayek himself. Even if you think you're familiar with the term, please read this.

- Immigration NZ continues to be an absolute mess. It's only partially the bureaucracy's fault. They'll have had whipsawing policy directives from the Ministers. First it's clamp down and don't process visas because Labour hates immigrants. Then the inevitable bad consequences from blocking migration, so they get told to stick every employer into the high-trust accredited employer visa programme to speed up processing - which pushes actually trustworthy employers into the same queue with a bunch that really really aren't. And the inevitable consequence of that. Absolute mess. Herald, Stuff. The Stuff piece is particularly good.

- RBNZ figures that migration might now be reducing inflationary pressure rather than adding to it - easing labour supply bottlenecks.

- In today's edition of "China is actually a more stable and reliable trade partner than the US," Trump promises 10% across-the-board tariffs if elected. Shouldn't US foreign policy aim at encouraging deeper trade links with the US and reduced reliance on China?

- Action on Smoking and Health is getting fed up with BS coming from Health Coalition Aotearoa.

Tuesday, 22 August 2023

Shakedown

The government's released the Fair Digital News Bargaining Bill.

It sounds a lot like what Canada put in place - and that resulted in Facebook blocking all links to news rather than being compelled to go into arbitration that could lead to unpredictably humongous settlements against it for linking to news.

Over at BusinessDesk, Dan Dunkley notes that one of the government's justifications for the bill is that government funding of media undermines trust in media. I really don't get how strongarming tech companies into funding media companies is that much better: avoiding that threat requires being deemed to have given 'enough' to whichever media companies the BSA (and presumably the Minister behind the scenes) figure ought to be paid off.

My column in the weekend's Dom Post:

Shakedown rackets are, thankfully, illegal.

Except when government legislates them. In that case, all bets are off. And if I were Facebook, I’d be off too – or at least thinking about it.

The Government finally released the Fair Digital News Bargaining Bill this week. The bill aims to improve news funding by requiring payments from those who link to news online.

Similar legislation caused Meta, Facebook’s parent company, to block all news links in Canada.

So what’s in the New Zealand version?

The legislation puts the Broadcasting Standards Authority (BSA) in charge of a new bargaining framework.

News outlets overseen by a recognised regulatory body like the Media Council, or subject to a standards code, can apply for registration.

It’s the other side of the bargaining table that gets trickier.

Any internet service that makes news content produced by news media entities available to people in New Zealand is considered a digital platform. The definition is very broad – simply facilitating access to news content, for example, by linking, is sufficient.

If you control such a platform, whether directly or indirectly, you’re considered an operator, and potentially subject to registration under the legislation.

The legislation is obviously aimed at Google and Facebook, and potentially Twitter and the Microsoft start page. But the definition of ‘platform’ is much broader. It probably covers Dr Bryce Edwards’ daily online news roundup at Victoria University, and my organisation’s own weekly newsletter. Both link to news.

But the BSA will only register some platform operators. If the BSA believes the platform operator has more than a minor power advantage over a news media entity, it can impose registration.

It’s an odd thing, that power imbalance. A news outlet can set a paywall and can prevent platforms from indexing or scraping content, at the outlet’s sole discretion.

But here, the BSA would consider bargaining power in deals over whether a platform will pay a news entity for the privilege of providing links. And since a platform operator can always decline to pay for links – because links have been free since the Internet was first created – there will be some power imbalance.

The BSA may give regard to a host of different considerations when deciding whether to register an operator. But just how that will work will be impossible to tell until the BSA starts making decisions. And that makes it risky to be a potentially registered operator if the bill passes.

Once a platform is registered, news outlets can initiate bargaining. Parties are under a duty to bargain in good faith and are subject to hefty penalties otherwise. If they cannot come to agreement, a panel of arbitrators is appointed. The parties put up their final offers.

And the arbitrators must choose the offer that “fairly compensates the news media entity party for that party’s news content being made available”.

The whole process is incredibly risky from a platform operator’s side. The news company takes on no risk. Even though the consultancy report produced for the Ministry of Culture and Heritage found that platforms provide considerable commercial benefits to news companies, payments here will only go one way. But it’s impossible to tell just what kind of final offer an arbitration panel would consider ‘fair compensation’.

In a traditional shakedown racket, a mafia boss threatens vague terrible harms if the ‘protected’ business owner doesn’t pay up enough protection money. It’s an offer you’re not meant to refuse.

The Fair Digital News Bargaining Bill has its own shakedown option. A platform can be granted a five-year exemption from bargaining processes if the BSA thinks the platform already makes “a fair contribution” towards news production.

What counts as a fair contribution? It’s hard to say. Broadcasting and Media Minister Willie Jackson has made clear that he wants the platforms to make deals with media outlets. Offer enough, and you won’t have to deal with complicated risky arbitration. Do you feel lucky?

But instead of facing the certainty of a tax code, platforms would face the constant uncertainty of trying to figure out which media outlets need to be paid off by how much to satisfy the minister and the BSA.

As in Canada, there may remain a safer way of avoiding all of it – though I expect anyone with skin in this game is talking it through with lawyers rather than economists.

Arbitrators are required to choose the offer that provides fair compensation to the news outlet for news content being made available.

If the platform stops providing access to news, its final offer in arbitration could be simple. “We do not provide access to news, so our offer is $0.”

Hopefully the bill dies on the order paper after Parliament rises for the election and is not picked up again after the election.

But it is disgraceful that shakedown legislation of this sort has even made it to Parliament for consideration.

Monday, 21 August 2023

Evening roundup

Another closing of the tabs:

- "This is troubling because the government is spending hundreds of millions of dollars in subsidy money to improve a recycling rate it can’t even measure."

- Pattrick Smellie on state of play in NZ craft brewing.

- I've a column on infrastructure funding and financing in the Local Government Business Forum newsletter.

- Michael Reddell on inflation forecasts and RBNZ monetary policy.

- More grid-scale solar coming in - Genesis to have 500 MW of new solar by 2026.

- A follow-up on Tamaki redevelopment. It's a neat one. Started under National, completed under Labour, seemed to work...

- Ugh. If Semour here means that dairies would have an easy time getting a liquor licence, rather than even more restrictions on where vapes could be sold, that would be ok. But I don't think he means that.

- On the plus side, on-farm sequestration that stacks up will be included in the ETS. On the downside, another two-year delay on emission pricing for ag methane.

- On the plus side, National would have better targeting of prescription drug subsidies. On the downside, they'd also have more political direction of which drugs get funded - a list of cancer drugs.

- ACT supports a Carbon Tax Refund - basically a carbon dividend.

- Scott Wilson with some history of NZ's land transport funding system. A really excellent post, the first of a promised series.

2023, as forecast in 2019

At Budget 2019, Treasury put up projections through 2023.

According to those projections, which incorporated Treasury's best guesses about everything that was going into the Budget, Core Crown tax revenue would be 28.8% of GDP in 2023. Core Crown expenses would also be 28.8% of GDP.

Covid happened in 2020 and all bets were off for that period. But Covid-spend has now largely worked its way through. Spending should be getting back to what was forecast for 2023 in 2019, right?

Nope.

Core crown tax revenue at the Budget Economic and Fiscal Update 2023 was 29.3% of GDP and Core Crown Expenses were estimated at 32.5% of GDP. So spending in 2023 is more than three percentage points of GDP higher than the government had forecast in 2019.

I covered a bit of this at the Financial Services Council conference last week in Auckland; Jarod Kerr and I were on a Chief Economists' panel with Jack Tame.

Transport GPS

The draft Transport Government Policy Statement is out for consultation.

That statement lays out the government's intentions around transport.

One thing that stood out was the number of times it talks about an imperative to reduce Vehicle Kilometers Travelled.

Now reduced VKT could well be an outcome of rising carbon prices, but it should hardly be an objective for the agency charged with building and maintaining roads - acting on behalf of drivers.

I'd hope an incoming better government would get rid of that. NZTA ought to be responding to their best guesses at transport demand as carbon prices rise, not throttling private vehicle use.

But another thing stood out.

When the government set the petrol excise holiday, the Taxpayers Union wanted it to be permanent on basis of that some money gets spent from the National Land Transport Fund on non-road stuff. But the Crown also throws money into the roads from outside the NLTF and it looked like it was roughly a wash. At least at the time.

Here's what it'll look like over the coming decade.

Saturday, 19 August 2023

GST carveouts

- RNZ morning report. They couldn't find tax expert or economist who supports the idea. I show up a bit in here.

- Jo Moir at Newsroom points out some of the problems. Marc Daalder says its government by focus group.

- They're paying for this mess by getting rid of depreciation for commercial buildings. But commercial buildings depreciate. So they're funding the creation of a distortion by creating another distortion. Dumb. Dumber than a sack of hammers.

- I'd hit some of the problems in Newsroom, when it was just a rumor. And at RNZ.

- I hit it again after the announcement, noting the obvious alternative of just increasing the bottom tax threshold.

Friday, 18 August 2023

Forestry and the ETS

I got our submission in on the ETS review and forestry just under the wire last Friday.

For those interested, it's here.

I really hate the precedent that the government is setting here.

Farmers are mad about afforestation, and afforestation can have adverse consequences that have nothing to do with net emissions. But those can and should be dealt with by the parts of government best suited to dealing with each of them as they arise.

The alternative to sound Tinbergen-style policy is that we wind up in consultations about different ways of breaking the ETS every time changing carbon prices lead to changes in activities that have their own potential externalities.

I go through a few examples:

2.12 Consider the perils of the alternative approach, which would require the ETS to reconsider which forms of carbon sequestration or gross emission reduction it might recognise or to what extent – because carbon prices encourage ‘too much’ of the activity resulting in other ancillary problems. A few simple hypothetical examples follow:

2.12..1 Carbon sequestration through olivine transformation proves highly cost-effective, but olivine mining causes changes in land use and community concerns about heavy truck traffic. Rather than use consenting processes to mitigate externalities from mining or appropriate road-user charging and roading upgrades to deal with truck traffic, the Climate Commission is asked to pretend that this form of direct-air capture carbon sequestration does not sequester carbon – to reduce the incentive to engage in olivine mining.

2.12..1.1 A new methane inhibitor for livestock proves highly cost-effective in reducing biogenic methane emissions. For sake of argument, let us imagine that this happens after biogenic methane emissions are brought fully into the ETS as CO2-e and are subject to the ETS cap – or are subject to their own methane trading system. The new methane inhibitor unfortunately increases nitrogen concentration in cattle urine. And because dairy farmers face lower methane charges with lower emissions, dairy farming becomes more profitable and there is an increase in dairy conversions. All of it puts increased pressure on overburdened water catchments. Rather than appropriately regulate water quality, the government asks the Climate Commission to put a thumb on the scales to discourage use of the methane inhibitor.

2.12..1.2 A new type of cement is developed that produces vastly fewer emissions. The technology for producing the cement powder is owned by an overseas company who can easily deliver the powder to New Zealand; when used here, emissions from cement are trivially low. But because the overseas company will not licence the powder to large domestic incumbent cement producers and because it will outcompete domestically produced cement, the incumbent faces difficulty. The Climate Commission is asked to level the playing field by requiring surrender of NZU for use of the new cement as though it had the same emissions profile as existing cement – to avoid unemployment at community cement plants. A ‘just transition’ path is suggested that would allow the new cement to be treated fairly in twenty years’ time.

2.12..1.3 A new direct-air carbon capture technology is developed. It can sequester carbon at a cost of $50/tonne and can scale infinitely. It could not only offset the entirety of New Zealand’s gross emissions, but also prior emissions if allowed to run at scale. The Climate Commission is asked not to recognise this new technology because, if it were allowed to generate NZU at $50/tonne, there would be weaker incentive to reduce gross emissions and New Zealand would not achieve the wholescale industrial, social, and economic transformation that some might otherwise desire.

2.12..1.4 A high carbon price makes people wish to avoid housing that has high carbon cost and prefer apartments and townhouses near the city centre. However, cultural concerns are raised about the shift away from suburban living, with commensurate concern about potential reductions in family size and an aging population. A conservative government encourages the Commission to consider a higher NZU surrender requirement for electricity used in apartments as compared to electricity used in detached suburban homes to avoid this undesirable change in housing use.

2.12..1.5 A rising price on biogenic methane emissions in agriculture, when those emissions finally face an emission price, results in reduced herd sizes and changes in rural land use. The Commission is asked to redo methane accounting to reduce the likelihood that emission pricing results in land use change, because of a view that emissions prices were not intended to result in land use changes.

It is also interesting that the agricultural sector, which has been able to successfully evade pricing on biogenic methane for ages, is also lobbying for changes to the ETS that would sharply increase the marginal cost of reducing net emissions within the covered sector.

Afternoon roundup

Some of the worthies as I attempt to get the tabs down to a more manageable level...

- Michael Reddell keeps documenting the problems at RBNZ. They make stuff up when reporting to the Finance and Expenditure Committee. "But it gets harder to believe such a pro-incumbent bias is playing no part (consciously or unconsciously) in their words and actions."

- Most polled restaurant owners would make covid-infectious employees show up to work. Great advertisement for restaurants.

- If a rezoning increases your property value by more than 7 times, then either council's supplying free-to-users infrastructure that ought to be covered by charges on users over time, or it isn't zoning anywhere near enough land, or both.

- One reason for crypto-regulation: add a large fixed cost to a low marginal cost service to protect incumbents.

- A link tax won't save the newspaper industry.

- Helen Clark chats Ukraine war with Australian defence expert Mick Ryan.

- NZ's alcohol licensing authorities still are J-Curve deniers.

Wednesday, 9 August 2023

End to the golden trade weather

Vangelis Vitalis knows what he's talking about in trade, making this particularly depressing.

At BusinessDesk ($, you should subscribe; I do)

Vitalis said the rules NZ depended on at the WTO were no longer fit for purpose.

“We can still take cases, but their foreseeability now is really in question because you can no longer hear appeals to the case.”

Geopolitics

Vitalis said geopolitics was back in a way “that we have not experienced previously”, particularly between China and the United States which was “intense and difficult”.

“Don’t get caught in the cross fire. If you’re in any doubt about how challenging and bruising this can get, just ask Australian wine exporters, just ask Australia barley exporters, just ask Australia coal exporters.”

As recently as the weekend, Australia withdrew its action against China at the WTO after it dropped tariffs on Australia barley, which had been in place for three years.

Australia is, however, still pursuing its action on wine tariffs.

Vitalis said the challenges out there were real and NZ was going to need to think about how it managed and mitigated those risks.

NZ had relied on US leadership in trade policy for big achievements, such as Uruguay Round, however they were no longer in that space.

China is a more reliable trade partner for New Zealand than the US is, if New Zealand is willing to never say much about the Chinese Government's atrocities.

The US claims to be a partner and claims to want to reduce Chinese influence in the Pacific. But when it comes down to it, Congress is more interested in protecting its farmers from competition from NZ meat and dairy. Persistent problems in US baby formula supply chains; NZ has lots to sell, but the US prefers to keep blocking it.

So if you're Prime Minister, what the hell do you do?

Take a more principled stand on geopolitics, which would likely mean sharp restrictions on NZ exports to China and continued US refusal to allow imports from NZ? Get friendlier with China, which could make it harder for NZ to keep doing awesome stuff in the aerospace sector that depends on tech transfer agreements with the US? Try to keep balancing on an ever-narrowing beam?

Tuesday, 8 August 2023

Canadian cautionary tales

My column in the weekend Dom went through Canada's messes in trying to make Google and Facebook subsidise Canadian newspapers.

The Canadian Government passed Bill C-18, the Online News Act. And now, Canadians wanting to link to a news story on Facebook see this notice instead.

Earlier this week, I interviewed the University of Ottawa’s Professor Michael Geist about the problem. He’s the Canada Research Chair in Internet and E-Commerce Law and has been following C-18 more closely than anyone.

Bill C-18 requires Facebook to pay whenever a user puts up a link to a news site. It is not a cost that Facebook can easily control or predict. It brings potentially unbounded liability.

News links are not particularly valuable to Facebook. If anything, links to news stories encourage users to click away from Facebook rather than stay on the site scrolling through pictures of relatives’ pets and children, and seeing ads delivered through Facebook while they’re there.

Facebook provided plenty of warning that they'd sooner stop allowing user links to news on their platform than be subject to unpredictable and potentially very large payments for allowing such links.

Willie Jackson says the NZ government will have legislation in the background in case Google and Facebook don't fork over enough money to NZ media companies. It would go to arbitration.

Listen to his interview, above-linked, and tell me this isn't a tin-pot shake-down. There can be defensible public-goods arguments for subsidising news production, but I just can't see why that ought to be funded by some tax or shake-down of tech companies.

It sounded like he figures that Google fronting up $50 million might cover it. Who knows.

But threat of going to arbitration with unknowable potential liability is what's had Meta pull news links in Canada. Listen to my chat with Michael Geist on it, or read his substacks.

From my column again:

Finally, on August 1, Facebook began pulling the plug. Canadian Facebook users will no longer see news links and content. It affects not just Canadian news sites but also international news for Canadian readers, because the Online News Act can also be read as requiring payment for links to international sites too.

The big newspapers are getting exactly what they asked for. They thought that Facebook was stealing from them by linking. It’s always been nonsense – even the report commissioned by New Zealand’s Ministry of Culture and Heritage found that “digital platforms provide considerable commercial benefits to news firms”.

But, like Trump, they’d convinced themselves that they could have something for nothing. They could have media funding and make Big Tech pay for it. And it’s worked out about as well as Trumps’s wall.

Professor Geist explained that some of the biggest losers from Bill C-18 have been small independent news sites that have relied on links from Facebook for traffic.

I hope that our Minister for Broadcasting and Media, Willie Jackson, is paying attention to Canada’s cautionary tale.

Extorting payments from platforms to meet the Government’s news funding objectives isn’t just thuggish. It also doesn’t work.

Will look forward to seeing the eventual legislation...

Afternoon roundup

The worthies, on a long-overdue closing of the browser tabs:

- Colby Cosh explains to Canadians something Kiwis have known for some time: the Party commanding the confidence of the house gets the Prime Ministership. And that might not be the largest party in Parliament.

- New Zealand's judges keep bringing the administration of justice into disrepute.

- Attempts to stop people from renting their houses to tourists on AirBnB. If cities just let people build more housing, none of this would be any kind of issue.

- Agriculture emission pricing gets punted to post-election. It would have been heroic for Hipkins to hit this while milk prices are tanking.

- ACT proposes weakening the medical licensing cartel.

- The government adds a pile of cost-increasing conditions for receipt of film subsidies. It may have the laudable effect of reducing demand for film subsidies. Or, perhaps down the track, lead to higher subsidies to offset the cost imposed by stuff like carbon footprint audits.

Leave GST alone

New Zealand's Finance Minister keeps sending signals that Labour's preparing to break GST.

Vernon Small pointed to the GST guff as evidence that we're now deeply into the silly season, where no policy can be expected to make a lick of sense and everything is targeted at the election.

Stupidity here doesn’t just mean something I don’t like, or something economists in general don’t like. A policy is stupid if it is a terrible way of trying to achieve any reasonable objective, if it is incredibly costly relative to other available alternatives, and if it wrecks other important objectives along the way.

Taking GST off food generally, or from fruit and vegetables, is stupid.

Yes, other countries do not impose GST on food or have other exemptions for worthy-sounding goods or services. But those kinds of holes in GST come at substantial cost. They make it harder for the government to raise revenue for the things voters want, while imposing insane administrative costs.

And remember the excellent old post by Stephen Gordon over at Worthwhile Canadian Initiative on the Nigel Tufnel approach to tax economics.

No matter how thoroughly you explain that a consumption tax can be partnered with other taxes and transfers to achieve whatever tax system progressivity someone might want, the idiots will just keep saying, "But GST is regressive."

The NDP has never been a fan of the GST, and persuading Canadian progressives of its merits is a never-ending variation on the theme of "but these go to eleven:"

Progressive Person: How do we raise the tax revenues we need for the social programs we want to implement without tanking the economy?

Economist: Consumption taxes. Theory says that consumption taxes such as the GST are the least-disruptive way of generating tax revenue, and available evidence appears to be consistent with the theory.

PP: But consumption taxes are regressive!

E: Yes, but we can correct for that using targeted transfers to low-income households so that they aren't worse off; that's what the GST rebate is for. And there will still be lots left over to fund those social programs.

PP: But consumption taxes are regressive!

E: I know. But they introduce fewer distortions than the alternatives, and we can recompense low-income households for their lost buying power.

PP: But consumption taxes are regressive!

E: I'm not disputing that point, but there's more to the analysis than that. Okay, let me explain the effects of the various forms of taxes...

<15 years later>

E: ...and so we see that a consumption tax accompanied by direct transfers to low-income households is the most effective way of generating the tax revenues you want.

PP: But consumption taxes are regressive!

Clearly, that's a dramatisation: in real life, it would never have occurred to a progressive to ask an economist how to finance social programs without tanking the economy. But below the fold, I'll try to summarise once again why the NDP should abandon its traditional antipathy to the GST and start to view it as an important instrument in advancing its agenda.

These kinds of debates ought to remind us just how lucky we are that tax decisions are generally delegated to experts and kept far away from voters. Policy could be so much worse than it actually is. As bad as things are, it could always be far far worse.