Late last year, the government passed legislation intended to sharply reduce the sale and consumption of legal tobacco.

It is also intended to reduce smoking rates; how good a job it will do with that will depend on how efficient the smugglers get. But it will definitely reduce the sale of legal tobacco that draws excise.

From 1 April 2025, Very Low Nicotine Concentration rules will be in force. Only authorised tobacco products will be allowed to be sold, and only tobacco products with less than 0.8 mg/g nicotine content will be allowed. That's section 57I of the revised Smokefree Environments and Regulated Products Act.

How much is 0.8 mg/g?

Sources vary a bit. But this CDC study had mean nicotine concentrations in cigarettes of 19.2 mg/g.

So the rules reduce nicotine concentration by over 95%.

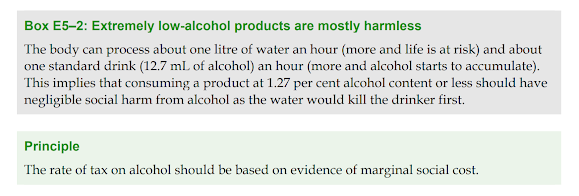

Or to put it a different way, if a normal beer has 5% alcohol, this is like reducing the maximum alcohol content to 0.21%.

The level is low enough that it simply isn't plausible that people would start smoking a lot more, or smoking more heavily, to try to get those last bits of nicotine. It would be like trying to get drunk on 0.21% beer. It just isn't going to happen. As my most favourite footnote in a tax review put it, you'd die of water poisoning well before you ever hit alcohol poisoning at those kinds of concentrations. [I've snipped the bit from the Henry Review as footnote because it's just so good.]

Ok. So we're all on the same page here right? The intended and near-certain effect of the legislation is to cause a very sharp reduction in the number of legally purchased cigarettes that draw excise.

How big will be the effect? Your thumb-suck is as good as mine, and better than mine if you're a smoker.

But let's think it through.

In the month or two before the new rule comes in, I expect massive stockpiling of real cigarettes. It will give a surge in excise returns for FY 2024/5. Smokers who can afford to will buy however months' supply is plausible to store. An unopened pack probably stays fresh for at least a year, maybe two?

I do not think it crazy to expect this. Remember that, when government used to do big increases in excise, it would do them on very short notice specifically with intention of avoiding stockpiling of cheap pre-hike cigs. We have two years to prepare for this one. I expect everyone will be fully responding to incentives: there will be ample supply to meet stockpiling needs ahead of the rule change.

Households will stockpile their own cigs. Many households that smoke will be unable to afford to do so. Others will stockpile real cigarettes on their behalf, and sell them illicitly afterwards - a greyish market competition to the black market that will be out there.

So FY 2024 will see a surge in tobacco excise returns, much of which will be a bringing forward of excise returns that would have obtained in FY 2025.

Cigarette sales will plummet in April 2025.

Some who'd been completely unaware that the change was coming will buy the new cigarettes and learn whether they want to keep buying them.

As others work through their stockpiles, they'll do the same thing: buy a pack of the new cigarettes, then decide whether to flip to something else or try another pack; try that next pack, decide whether to stick with them or flip to something else. And so on. There'll be incoming new-tryers and a decay function.

Say that stockpiles are largely run-down by October 2025. We're likely to be at steady state or close to it by April 2026. Some proportion of current smokers will have quit; some will have shifted to vapes; some will have shifted to the black market; and, some will continue to smoke VLNC cigarettes.

A VLNC cigarette is like a 0.2% beer. What do you think steady state looks like?

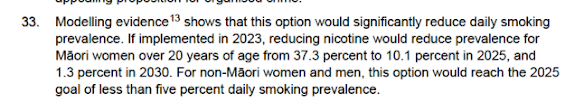

Well, MoH gave what it thought the answer was. It's in the 2021 RIS. They expect that it would take two years for smoking rates to drop by 73%.

If half of that drop is in the first year, then they're expecting the sale of excised cigarettes to drop by about 36% in the first year.

So the Ministry of Health's Regulatory Impact Statement on its SmokeFree intentions had VLNC rules reducing smoking rates by about that amount. We can safely leave aside arguments about black market or whatever else. This is just the Ministry's projections assuming no shifts to the black market, which doesn't pay excise anyway so doesn't matter.

What do you think happens to collected tobacco excise if the legislation works in the way that the Ministry of Health intended and projected?

I think it's safest to assume that tobacco excise revenues, in 2026, after we've gotten through whatever surge and trough was due to stockpiling, are going to be a lot lower. 1 April 2026 is one year after the law comes in. Sales of excised tobacco should be 36% lower at the start of the year and decline by another 36% over the course of the year.

That means excise will be about half of what it otherwise would have been, for 2026, and much lower after that.

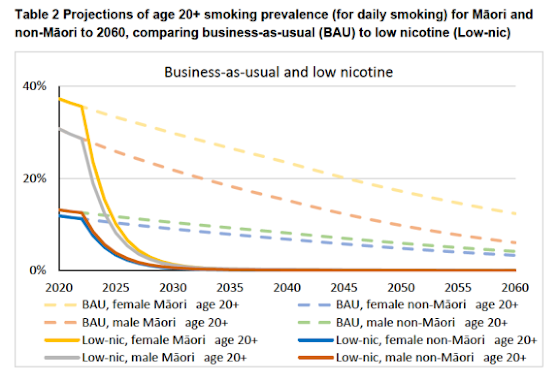

Recall that Minister Robertson promises a return to fiscal surplus in 2026. OBEGAL of $600 million.

But let's have a look over in the notes. It's always good to look in the notes. And there we see Treasury figuring that the government will collect $1.710 billion in tobacco excise. They've projected a slow and steady decline in tobacco excise revenues, in line with overall declines in smoking rates. They've obviously not factored the VLNC rules into their workings yet.

And fair enough. It can take a while to run the figures. This has taken me about 20 minutes, but it's very thumb-suck.

As a rough cut, I expect tobacco excise in 2026 to be about half of what it otherwise would have been. So a drop in revenue of $855 million as compared to forecast.

So a $600 million 2026 surplus becomes a $255 million deficit.

This isn't a criticism of the SmokeFree policy. It's the just working through the implications of the policy as promised.

The government is trying to have it both ways here. It wants the reductions in smoking, but wants to pretend there won't be any effects on revenues. It cannot have both. It's one or the other.

I've called it the cigarette burn in the Crown Accounts.

What really really does puzzle me is why Treasury didn't bother including it as a substantial fiscal risk in BEFU. It's a lot more than the $100 million threshold for inclusion.

Had a short column over in The Dom on it.

FOOTNOTE

Finally, the bit from the Henry Review. So fun.