Both in question time and the budget debate last week, [Key] trumpeted National’s incredible jobs achievement:

“… New Zealand now has more jobs that it has ever had in the history of this country. I do not call that failure.” Taddah!

Um, John, more people have jobs now because New Zealand has more people now. It has very little to do with you. Unless, of course, you are about to start taking credit for breeding...

As the chart shows, the number of people in work rises pretty much every quarter, unless there is a large-scale problem like a Global Financial Crisis. More people, more jobs.

The unemployment rate is a much better indicator of government economic management than is the raw number of jobs around.It's a bit odd that Salmond cuts his data series at 2000; most Stats NZ series go back to 1986. If we extend the data series showing number of persons employed back to 1986, we see a few declines in numbers employed despite there being no drop in year-on-year population

Then again, what if we did adopt John Key’s “more jobs than ever before” standard for judging government economic success? How would the last two governments perform on that score?

There's a decline in total employment from '87 through '92, a nice rise from '93-'96, a levelling off from '97-'99, then the rise Salmond shows from 2000 through the most recent recession. Note that the y-axis cuts at 1200; this makes dips and rises seem larger than they really are [Salmond's has a similar cut].

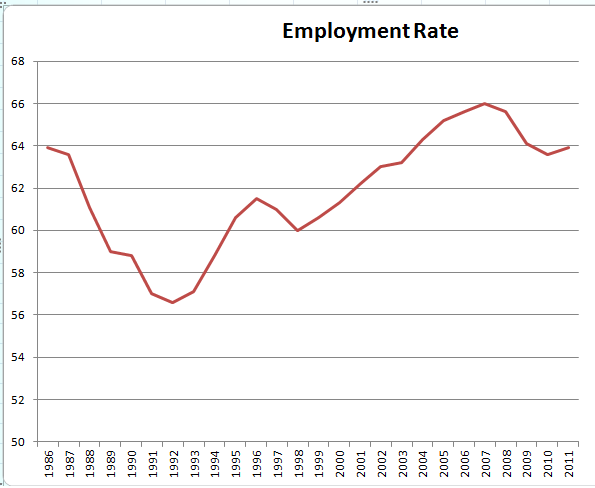

But, as Salmond rightly says, total employment really isn't a great measure without some correction for population; we really need to look at the employment rate. So, how's the employment rate doing? Here's the graph:

When I look at that chart, I see an abnormal bulge starting around 2005 - about the period when RBNZ let inflation get a bit out of hand - then levelling down to more more normal ranges. The employment rate isn't higher than it's ever been, but neither is it completely out of whack relative to the full Stats NZ time series or relative to the drop in the employment rate in prior recessions.

And, the unemployment rate isn't as bad as Salmond suggests. Let's start by going back to the start of the data series in 1986 instead of cutting it at 2000.

Put in a bit of a broader historical context, it's not bad. I'd expect that Salmond was cutting things at 2000 to get a rough decade period, but the impression left by the time series sure changes depending on our choice of start date. And, when we remember that the period from 2008 onwards has been rather worse for the global economy than any period since '86, and that the 2002-2007 period was part of a global boom, we might well be reasonably pleased at current outcomes; it's far worse elsewhere. HLFS data has a nice way of showing what lenses folks are using.

Update: Rob Hosking at NBR agrees and adds that, with employment rates this high and wage growth picking up, there's less room for non-inflationary growth. It's also worth remembering that our employment rates stay high and our unemployment rates stay low in part because of the big labour sink across the ditch: it's easy for our unemployed to move to Oz, and it's not always easy to draw them back when things here pick up. But the iPredict markets don't see inflation anywhere on the horizon.

* Update: dumb typo. Of course population growth rates vary. But population always grows. So absolute drops in numbers employed can't be due to drops in population. Last line and link added in too as I realised I'd forgotten to add it and that the post title made no sense without it. Oops. It's also worth remembering that Key talked about numbers employed at least in part because Shearer kept talking about the increase in the number of people unemployed over the last 4 years. Check the links to Hansard in Salmond's post.

** I'm not sure if the Table Builder link will keep working or whether it's using a session ID. I'm using the annual series to get a cleaner x-axis.

I think the two points I was making in my post were: (1) The PM is playing silly buggers claiming macroeconomic victory based on a dumb metric (raw # jobs); and (2) the unemployment rate is a better metric than the raw number of jobs. Your post here seems to ultimately agree with those two points, but bemoans the lack of 26 years of data in my post.

ReplyDeleteI do not think I need to explain 26 full years of NZ labour history to make my two simple points. Hence the shorter series in the illustrative charts. The two additional jobs slumps you identify are, however, entirely consistent with my theory that more people begets more jobs in the absence of major international strife. The 87-92 dip you see is the global sharemarket crash and its aftermath, and the late 90s dip is the Asian financial crisis.

You also suggest that the employment rate is another good metric. I broadly agree, and it also shows a deteriorating performance over the last little while. Note I never said anything about all time worst performances and such in my post, and I happily concur that the employment rate is higher than at most points in our history. Again, however, there are plenty of reasons for that rise that have little to do with the government of the day. As non-earning women leave the labour force and are replaced by younger women who want to earn, for example, the employment rate should slowly rise. For my money, [people who want work but have none / all people who want to work] is the better metric for seeing how much avaiable human capital the economy fails to utilize in a given year.

Rob: In the Hansards to which you linked, half the time Shearer went after Key for the number of people unemmployed, half the time he want after Key for the unemployment rate. And, in the same Hansards, Key talks about both the numbers and the rates. Sure, Key should have mentioned the employment rate in the one question you highlighted instead of the number of people employed. But when we do shift from numbers to rates, neither the employment rate nor the unemployment rate look all that terrible relative to the more informative fuller time series or relative to what's currently going on in the rest of the world.

DeleteOf course I agree that rates are better measures than the numbers employed or unemployed. But Shearer kinda invited Key onto the numbers ground in his response to the budget speech. One of his key lines there: "That man has delivered a Budget that has the worst growth in 50 years, has 50,000 people going to Australia, has delivered 50,000 more unemployed, and has 50,000 more people on benefits, costing us $1 billion." He kept going back to the "50,000 more unemployed". Is it any surprise that Key would counter "50,000 more unemployed" with "more people are employed now"?

I'm pretty happy either with employment rates or with unemployment rates; I went with the former first because that's the correct normalization of talk around the number of people in employment. They answer slightly different questions, but both are pretty defensible. You can get some weird stuff happening with unemployment rates around recessions though. The most recent increase in the quarterly unemployment rate seems more to reflect folks moving back into the labour force than any drop in jobs; both the employment and the unemployment rates went up, though the latter went up by more.

You didn't say worst performance of all time. But choice of starting dates in a graph can sure make it look that way. A lot of readers wind up extrapolating backwards from the a linear trend for the prior period. It's the kind of thing I'd expect in a partisan hit-job. With the broader time series, we more reasonably conclude that unemployment and unemployment rates experienced ca 2005-6 were anomalously low and probably were unsustainable even if we hadn't had the financial crisis and global recession.

I just don't think I needed 26 years of data, along with a full explanation of New Zealand labour history over that period, in order to make the point that [nominal N(jobs)] is a pretty stupid measure of government performance. I am usually with Orwell on this - "If it is possible to cut out a word, always cut it out."

ReplyDeleteAs for the opposition's use of nominal figures, certainly all politicians use particular figures with an eye to increasing the dramatic impact. But in the opposition's case at least the raw numbers and the rates are moving in the same direction. 36,000 NZers left for Aus in 2008, 50,000ish this year. If you do the calculations you'll find the rate is going up along with the raw number. Where this stuff becomes really problematic is, as in Key's case, where he uses an improvement in the raw number to mask a deterioration in the rate.

I doubt that a full explanation of NZ labour history was needed. But when it's easier to put up the full time series than a truncated series (Stats NZ's "select all" is easier than picking a shorter set of years), truncation that materially affects the reader's interpretation of a chart always seems a bit off.

DeleteAgreed that migration numbers sure aren't good and are keeping NZ unemployment figures from being rather worse. How much of that is Key's fault is more debatable.

Rob S's prime concern - as you rightly allude - appears to have been 'a partisan hit job' which isn't surprising given his strong Labour Party involvement.

ReplyDeleteBut the topic does raise some important issues which goes way beyond the Parliamentary face-pulling, because Key is partly right when he talks about the rate of employment.

Some work BNZ did on this a few weeks back highlighted the fact NZ's employment participation rate is one of the highest in the world right now. Germany is higher, and perhaps Australia, but that's about it.

Partly the reason seems to be flexible labour market rules, but obviously migration is a fairly hefty factor as well.

And whatever the cause, it means less 'spare capacity' [sorry about the quotes but I hate that term] and a probable wage inflation/skills shortage issue over the next few years.

iPredict's markets don't see much potential for inflation over the next few years. And, decent odds of strong recession - almost certainly due to the potential catastrophe coming up in Europe combined with Chinese slowdown. NZ's fundamentals aren't bad relative to the rest of the world. But a small place in the middle of nowhere has to run faster than everybody else just to keep up.

DeleteWhere Key needs to be kicked - hard and often - is on his complete refusal to deal with medium and longer term structural problems. We need to have that house in order so that we can credibly go to the debt markets should things turn really nasty in Europe. We have a harder time selling long term debt where the longer term fiscal outlook includes a nasty pile of superannuation cost.

The unemployment rate is not a great short-run measure of macroeconomic cylicality becuase of discouraged worker effects. (Would it really be a measure of success if the unemployment rate went down simply becuase some workers gave up looking?)

ReplyDeleteAnd I will disagree with both Eric and Rob in completely dismissing the raw numbers of jobs as a measure. Yes, over time, jobs will increase at roughly the increase in the labour force, and so the employment and unemployment rates are better indications of the state of the labour market. But that is a trend notion. If the economy is in a macroeconomic cylcical rut, it will not be generating jobs at the required rate. If the raw number of jobs is increasing at a steady rate, albeit not fast enough to match increases in the labour force, there is an indication that the issue is more micro than macro.