Anyway, here are the notes I put together for a couple of radio chats on it. They're not extensive notes, as I hadn't much time on this one.

- Most of the world competes for foreign investment. Some of that competition is silly, like the subsidy war that Amazon might get among cities for its new hub. NZ mostly doesn’t play that game, sensibly, although its film tax credit regime isn’t far. But the OIA regime is the opposite: it drives foreign investment away.

- In 2012, 80 of 198 countries had attracted a higher stock of inbound FDI as %GDP than had New Zealand. Per capita, Australia had attracted 45% more inwards FDI than NZ by 2012.

- Year on year changes in FDI flows will depend a lot on what’s going on in global markets and in the current exchange rate. January to August this year is a bit under a billion dollars more than last year. But it’s about a hundred million lower than January-August 2015. But Jan-August 2014 was much lower than last year. These things bounce around; it can be a bit silly to read too much into any particular year’s numbers. If we look back farther, the gross value of investment consideration Jan-August 2007 was 14 billion; it hasn’t been reported for 2017, but for 2016 it was just under 7 billion. You need more detailed work on what’s been going on in policy as well as exchange rates. And because NZ sees so little foreign investment as compared to other countries, it’s easy for a few big deals to push the numbers around disproportionately. The prior years' data is here.

- This year’s figures include Vero’s takeover of Tower Insurance. One of the big land transactions was 3600 hectares sold by Solid Energy to BT Mining. Mining’s about the only land sale where the buyer is digging up the ground and potentially sending it abroad – but solid energy would be doing that anyway. As for the rest, it isn't like foreign investors are digging up New Zealand farmland and sending it overseas. Foreign owners here are subject to all the same rules as domestic owners.

- NZ tops a lot of world rankings for ease of doing business. But we’re 32nd in the world, behind even Rwanda, on severity of restrictions on foreign ownership. Everybody talks about how protectionist Japan is; Japan’s less restrictive on foreign ownership than New Zealand on the rankings. Sweden is 7th least restrictive. Why are we celebrating scaring investment away when New Zealand firms can have trouble in access to capital? Foreign owners also can bring connections and expertise to the table that can be difficult to access domestically as well.

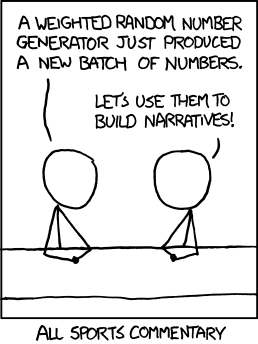

XKCD may be relevant here.

No comments:

Post a Comment