So.

The New Zealand government, committed to wellbeing, believing that tax is love, wanting to ensure that every loving tax dollar spent provides the greatest possible increase in wellbeing, and fronting the Christchurch Call to stop harmful speech,

has put $243,000 towards a Chinese propaganda film with the tagline "Anyone who offends China, no matter how remote, must be exterminated."

Thomas Coughlin has the story over at Stuff:

The film was not made directly by the Chinese Government, but by a slew of Chinese state-owned enterprises, including the China Film Group Corporation, China's largest film producer, and Bona Films.

Bona Films is a subsidiary of China Poly Group, another state-owned enterprise. China Poly Group is an unusual conglomerate housing the world's third largest art auction house and a real estate business, and has "longstanding ties to the military and the family of the former Chinese leader Deng Xiaoping," according to The New York Times.

The strong allegations made against the Chinese film industry's activities in New Zealand are made in forthcoming research from China expert Professor Anne-Marie Brady.

In it, she says growing cooperation between the Chinese and New Zealand film industries, combined with New Zealand's screen production grant means "taxpayers are now subsidising China's propaganda films".

Her concerns aren't just confined to Chinese films — she said the growing ties could have a chilling effect on New Zealand's own cinematic output.

I don't know quite how you get around this if you're going to have an international film subsidy regime.

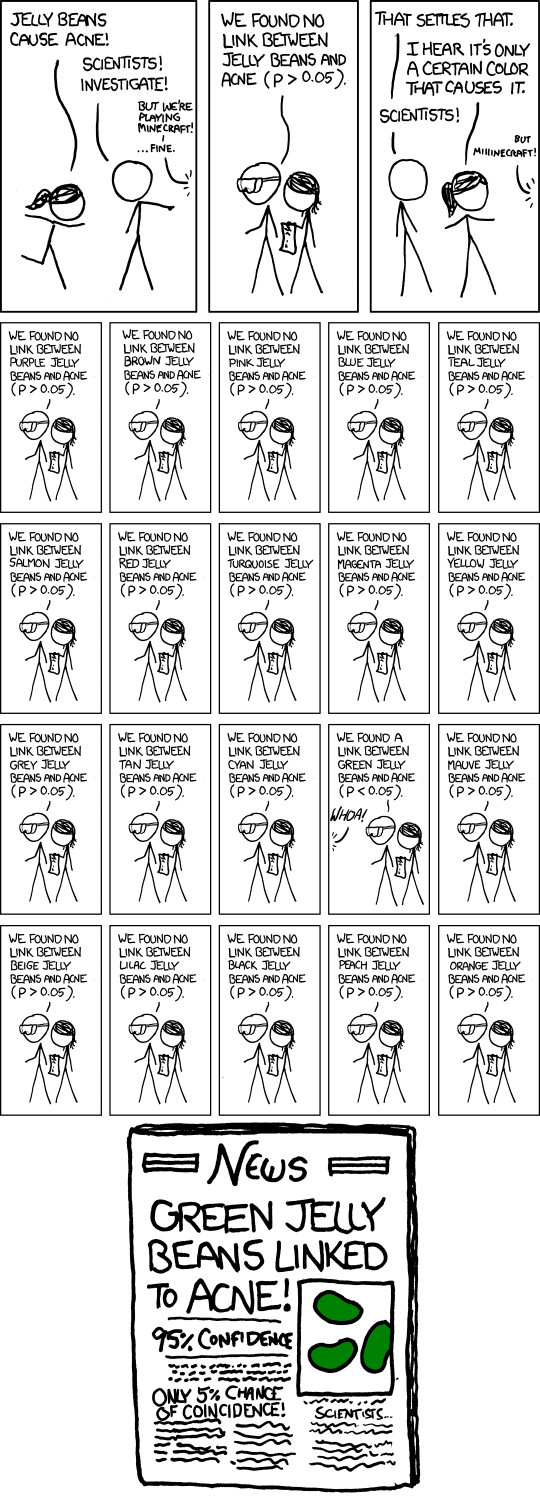

Like, maybe you could imagine some vetting to make sure we're not subsidising the production of propaganda films (dammit, I always misspell this and have to go back and correct, and I blame

these guys) for authoritarian governments. But can you

imagine the diplomatic mess where an arm of the NZ government tells film companies linked to the Chinese military and linked to the high echelons of the Chinese Communist Party folks that the NZ government considers their film to be authoritarian propaganda?

Not having international film subsidies would be a pretty clean way of not having to make those kinds of calls.

And, as reminder, the arguments for the subsidies are largely bunk.

You'll most frequently hear the argument that the subsidy is just a rebate on taxes paid here on activity that otherwise wouldn't have occurred here, so it's costless.

But that's wrong in general equilibrium. In the absence of film subsidies there would be fewer films made here, but people would work in other industries instead. Industries that do not get a tax subsidy. Those other industries are

smaller than they otherwise would be because resources have been competed away by the subsidised industry. The subsidy won't increase total employment, it'll rather shift the kinds of tasks that are undertaken here as compared to abroad.

The more sophisticated argument is that the artificially-large film sector makes it cheaper and more feasible to produce NZ content here. International film subsidies have brought production that's built facilities and expanded capabilities, so it's then easier for NZ On Screen to get actual New Zealand work produced.

And that's certainly true. But we have to ask about value for money. International film subsidies cost on the order of $100 per household per year - or at least that's what it worked out to when I'd looked at the budgeted spend for 2020 earlier this year. Add in additional cost for training subsidies to work in that industry to keep it at that scale. And think about what other valuable services all the smart folks working in that industry, because of subsidies, could have been providing elsewhere if they hadn't been pulled into film work because of the subsidy regime.

Is it really plausible that the typical household, if offered the chance to decide, would really want $100 from their annual tax bill going to pay for international film production here rather than being shifted to health, to education, to Pharmac, or to themselves in lower taxes?

2020's budgeted international film subsidies are $171.6 million. Pharmac's budget is around a billion per year. You could then increase Pharmac's budget by around 17% if you stopped paying international film companies to make movies here instead of elsewhere, and put the money instead into Pharmac.

Is it

plausible that whatever benefits are generated by international film subsidies, including that it makes it easier to produce great stuff like Wellington Paranormal and Hunt for the Wilderpeople, are higher than what we'd get by giving the money instead to Pharmac?

As for the argument that we have to keep subsidising the film industry because so many people now work in that industry...

my column in our Insights newsletter earlier this year:

We all know that best policy is not paying off the kidnappers. Countries that get in the habit of paying the kidnappers encourage the taking of more of their nationals as hostages. It’s a dangerous game to get into because it’s so hard to stop.

But would any country be so daft as to not only pay the kidnappers, but also deliver to them the next round of hostages as part of the bargain?

If you think no country would be so mad, think again. It’s how the film subsidy regime in New Zealand works – as it does in every other place that chooses to play the game.

Last September, The Herald’s Matt Nippert reported that the Labour-led government had decided to continue the previous National government’s film subsidy scheme. Minister Parker ruled out changes where thousands of jobs could be at risk because business viability was threatened by ending subsidies, and where commitments by the National government risked lawsuits if the subsidies ended.

So there are your hostages: thousands of workers in the film industry who would have to shift to other employment, or shift offshore, if the subsidies ended. And here’s the payment to the kidnappers: the budget estimated that New Zealand will spend $113.6 million on screen production grants targeting international productions this year, with $171.6 million budgeted for 2020 – or about $100 per household.

Meanwhile, a host of New Zealand government-funded polytechs and universities train students towards diplomas and bachelors in screen production, diplomas in on-screen acting, bachelors of design (stage and screen), certificates in applied filmmaking and television, and more.

The government is subsidising specialised training students for jobs in an industry that would shrink dramatically in the absence of further subsidies to that industry, and further subsidies to that industry are justified on the basis of the jobs that would be put at risk if the subsidies ever ended.

To put it plainly, the government is teeing up the next round of hostages.

Had governments been this smart in the early 1900s, subsidies for training in the fine art of making buggy-whips would have been accompanied with bans on cars to protect the jobs of the whip-makers.

To crib a line from an excellent ’80s Cold War film, the only winning move in the international film subsidy game is not to play.