Of course it’s a serious problem.

At BEFU 2019, Treasury forecast that the government’s policy programme would have Core Crown tax revenue and Core Crown expenses at 28.8% of GDP in 2023.

At BEFU 2023, Treasury forecast that the actual 2023 figures would be Core Crown tax revenue at 29.3% of GDP and Core Crown expenses at 32.5% of GDP.

PREFU will very likely show a worse track for tax revenue (weakening corporate tax take; weakening GDP forecasts in part on milk prices; finally correcting the error that Treasury made at BEFU in tobacco excise forecasting) but, in the absence of signaled policy changes, a worsening track for expenditures. GDP will be lower than forecast so the denominator gets lower. A worsening economy means more spending on the automatic bits that kick in: benefit payments, hardship grants and the like. So the numerator’s going to be higher.

I haven’t checked Westpac’s numbers but haven’t reason to second-guess them.

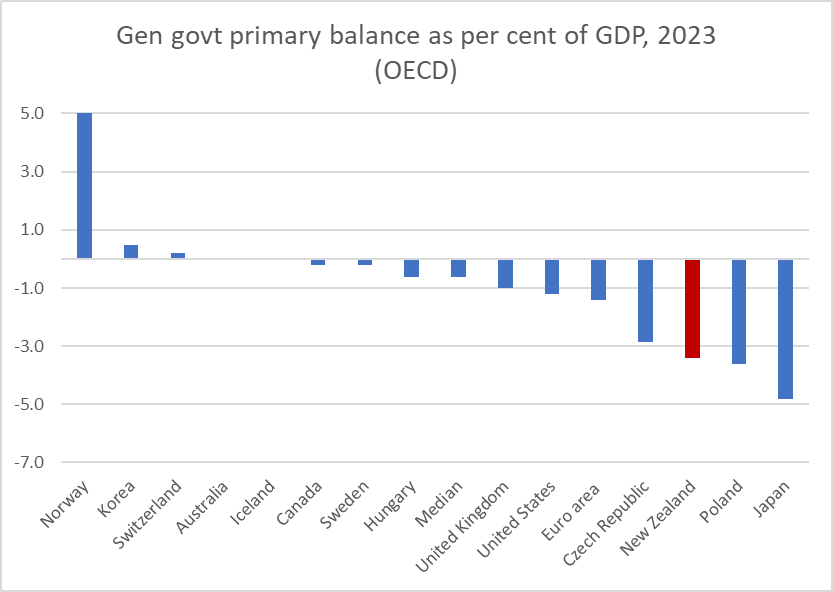

If we compare what Labour’s policy package had lined up, as of 2019, for 2023, it’s obvious that the problem isn’t on the revenue side. Revenue is up on the 2019 forecast. It’s spending that’s blown out. Debt and spending had to be part of the Covid response. But Michael Reddell’s shown that NZ’s fiscal response has been huge compared to other countries.

I’ve copied two of Michael’s charts below.

NZ started with a low net debt to GDP ratio. And still has a relatively low net debt to GDP ratio. But our increase in net debt was very large as compared to other countries, and the current general government primary balance is awful. Deficits that large might make sense in a recession, when tax revenues are down and spending on benefits is high. But doing this while the Reserve Bank is meant to be trying to get inflation back down is simply irresponsible.

The OBEGAL path presented at BEFU was not credible.

Treasury forgot that the government passed legislation banning the sale of cigarettes with nicotine in them from 1 April 2025; it projected a tobacco excise path that did not change with what amounts to tobacco prohibition. Recall that tobacco excise revenues are on the order of $1.7-$1.8 billion per year, and that the government’s projected surplus for 2026 was on the order of $0.6 billion. The VLNC rules bring forward the sharp drop in tobacco excise revenues that would otherwise have been expected further down the track. Annual tobacco excise revenues after 2026 are likely to be about a billion dollars lower than had been forecast at BEFU, on this single item, unless an incoming government eases the VLNC rules.

At the same time, large spending items like the food in schools programme were forecast to end at the end of 2024. It may be politically challenging for any incoming government to end that spending line in 2024. Treasury has to forecast based on what the government has legislated (barring its amnesia about the effect of tobacco prohibition on tobacco excise revenue). But expenditure paths that depend on decisions that are unlikely to be made may not be all that credible.

On the revenue side, inflation’s pressure on household after-tax disposable income is becoming intolerable. Had the income tax brackets been inflation-adjusted to 2017 levels, the median wage and salary earner’s after-tax income would be almost $1600 higher this year. Inflation-indexing only the bottom tax bracket would give $210 to everyone earning at least $17,000, and even the Job-Seeker benefit is now above that level. Coincidentally, that’s about as much as the government thinks its GST move on fruit and vegetables might save the average household.

At some point, the tax brackets will have to adjust to account for inflation. Failure to do so means more and more people on lower incomes wind up in higher tax brackets. But when it happens, tax revenue will drop.

Monday, 28 August 2023

Deficits and PREFU

Dan Brunskill got in touch last week asking whether the deficit is a serious problem and what's likely to come at PREFU. He only had room for a short bit of what I'd sent through, so I'll copy the rest here.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment