1957 BROADWAY LYRICSACTIONDear kindly Sergeant Krupke,You gotta understand:It's just our bringin' upkeThat gets us out of hand.Our mothers all are junkies,Our fathers all are drunks.ACTION AND JETSGolly Moses, natcherly we're punks!Gee, Officer Krupke, we're very upset;We never had the love that ev'ry child oughta get.We ain't no delinquents,We're misunderstood.Deep down inside us there is good!ACTIONThere is good!ALLThere is good, there is good,There is untapped good.Like inside, the worst of us is good.SNOWBOY(Spoken) That's a touchin' good story.ACTION(Spoken) Lemme tell it to the world!SNOWBOYJust tell it to the judge.ACTIONDear kindly Judge, your Honor,My parents treat me rough.With all their marijuana,They won't give me a puff.They didn't wanna have me,But somehow I was had.Leapin' lizards, that's why I'm so bad!DIESEL(As Judge) Right!Officer Krupke, you're really a square.This boy don't need a judge, he needs a [sic] analyst's care!It's just his neurosis that oughta be curbed.He's psychologically disturbed!ACTIONI'm disturbed!ALLWe're disturbed, we're disturbed,We're the most disturbed,Like we're psychologically disturbed.DIESEL(Spoken, as Judge) In the opinion on this court, this child is depraved on account he ain't had a normal home.ACTION(Spoken) Hey, I'm depraved on account I'm deprived.DIESELSo take him to a headshrinker.ACTION (Sings)My father is a bastard,My ma's an S.O.B.My grandpa's always plastered,My grandma pushes tea.My sister wears a mustache,My brother wears a dress.Goodness gracious, that's why I'm a mess!A-RAB (As Psychiatrist)Yes!Officer Krupke, you're really a slob.This boy don't need a doctor, just a good honest job.Society's played him a terrible trick,And sociologically he's sick!ACTIONI am sick!ALLWe are sick, we are sick,We are sick, sick, sick,Like we're sociologically sick!A-RABIn my opinion, this child don't need to have his head shrunk at all. Juvenile delinquency is purely a social disease.ACTION (spoken)Hey, I got a social disease!A-RAB (spoken)So take him to a social worker!ACTIONDear kindly social worker,They say go earn a buck.Like be a soda jerker,Which means like be a schmuck.It's not I'm anti-social,I'm only anti-work.Gloryosky, that's why I'm a jerk!BABY JOHN (As Social Worker)Eek!Officer Krupke, you've done it again.This boy don't need a job, he needs a year in the pen.It ain't just a question of misunderstood—Deep down inside him, he's no good!ACTIONI'm no good!ALLWe're no good, we're no good!We're no earthly good,Like the best of us is no damn good!DIESEL (As Judge)The trouble is he's crazy.A-RAB (As Psychiatrist)The trouble is he drinks.BABY JOHN (As Social Worker)The trouble is he's lazy.DIESELThe trouble is he stinks.A-RABThe trouble is he's growing.BABY JOHNThe trouble is he's grown.ALLKrupke, we got troubles of our own!Gee, Officer Krupke,We're down on our knees,'Cause no one wants a fellow with a social disease.Gee, Officer Krupke,What are we to do?Gee, Officer Krupke,Krup you!

Friday, 29 April 2022

They're depraved on account they're deprived!

Thursday, 28 April 2022

Morning roundup

The morning's worthies:

- Robert MacCulloch brings the prosecution's case against the RBNZ. A future better government will have some work to do in restoring Bank credibility. Firing the Board and Governor; resetting the Remit so it only cares about an inflation target; appointing a hawkish Governor who recognises that inflation is his job and climate change, as important as it is, is somebody else's job; and requiring that those on the Monetary Policy Committee have expertise in monetary policy rather than treating it as a conflict might be a start.

- This has got to be the stupidest argument in favour of recycling. It begins with a grudging recognition that most recycling is pointless, before saying it might be a gateway drug to caring more about climate. The more plausible explanation for the survey results: people who get warm fuzzy feelings about environmental things in general are more likely both to recycle and to buy an EV.

- The Government proposes a tax principles bill. I like that Minister Parker agrees that horizontal equity, vertical equity, administrative efficiency, and minimisation of tax-induced distortions are core tax principles. But he points to high EMTRs for some lower/middle income earners as evidence that the tax system isn't progressive. Progressivity is defined as the marginal tax rate being higher than the average. Those EMTRs will hit in over short ranges for some folks, and are bad, but they aren't really evidence against the tax system being progressive. And remember that some of our progressivity is delivered by transfers like Working for Families.

- The Niskanen Centre explains how EV subsidies are generally a bad idea - you wind up providing a lot of cheap EVs to rich people who don't drive them very much. But if you could get the people who put on the most kilometres into an EV, that could be good. Now what would set that kind of incentive? Carbon charges in fuel. Cost adds up fastest for high-users.

- A reader sent this through after my Newsroom piece on carbon forestry: the biodiversity within a pine forest.

- NZ has a lot of old people, but aged care facilities are shutting down. Why? Government banned immigration, so there are no nurses.

- Good piece from Dileepa Fonseca. Everybody complains about costs in the construction sector, so why don't we let the folks who put up excellent cheap apartments in South Korea, Singapore and Japan build some here? I suspect we'd also want to have Japan's zoning and consenting system. And abolish the Overseas Investment Act.

- Season 6 of Kids in the Hall starts in May. Get your Amazon Prime subscription ready.

- The unserious people oppose waste-to-energy plants, because the plants make it harder for them to push zero-consumption lifestyles. FFS any carbon dioxide coming out of them is in the ETS.

- Craig Renney makes the case for a Parliamentary Costings Office. I like the idea in principle; would be a fair few difficulties to work out in practice. To begin with, which Parties get access, and how much of the Office's time? If it's just Parliamentary parties, you introduce a barrier to entry. If it's everybody, you get every nutjob setting up a Party and demanding a costing on their pet thing. If it's allocated by vote share in prior election, that also puts in a bias toward the status quo. I still like the idea of a costings unit that runs rolling reviews of existing spend between elections.

- I'd missed this 2019 AEJ- Ec Policy piece. Sweden put in a high carbon tax; petrol use dropped a lot. NZ is part of the counterfactual synthetic Sweden used for comparison. The Swedish carbon tax is a lot higher than current ETS prices, but NZ ETS prices will rise. The regulators here seem to believe that prices won't ever affect transport emissions here. Sweden suggests otherwise.

- An urgent appeal that masking in classrooms be the default for winter.

- I really need to read this whole book. "Questioning the Entrepreneurial State", reviewed here. There has been far too much naive enthusiasm for the Entrepreneurial State approach in the dumber parts of the Ministries.

Tuesday, 26 April 2022

Forestry and the ETS

This week's column over in Newsroom goes through some proposed changes to the Emissions Trading Scheme that would have it stop awarding carbon credits for carbon sequestered in permanent exotic forests, because of non-carbon concerns.

The column is currently gated but should ungate tomorrow by removing the /pro from the URL. [Now ungated]

Obviously, the Tinbergen Rule applies. Use the ETS for carbon, and keep it as clean as you can. If there are other problems caused by exotic permanent forests, target those problems directly using their own instruments.

My submission on it focused on the Tinbergen Rule.

But something else in here has been bugging me.

For years, government has been pitching all kinds of programmes and regulations that simply cannot affect net emissions because they come up against the binding cap in the ETS. EV subsidies? They just free up credits for someone else to use. Coal boiler replacement subsidies? They just free up credits for someone else to use. Surtaxes on trucks that use a lot of fuel? They already paid their carbon bill. But if the surtax makes people shift to lower-emitting vehicles, that just frees up credits for someone else to use.

The usual response is that the government would take the opportunity to reduce the volume of credits issued in subsequent years, so the regulations do affect net emissions. And that could be true as far as it goes, but it would be more cost-effective just to reduce the cap without implementing the regulation. If the regulated sector is the most cost-effective spot for reductions, the higher ETS prices will find that out. If it isn't, we'll find more cost-effective ways of reducing emissions.

But when it comes to exotic forests, the usual response gets flipped on its head. The same sorts who'll roll their eyes about the waterbed effect because of the opportunity to cut the cap faster will tell you that planting forests reduces the incentive to invest in lower-carbon processes because there are then too many ETS credits around at too low a price. But surely they'd have to see the opportunity for just cutting the cap faster right?

If your basic model of the ETS is that governments can cut the cap faster in response to regs that reduce gross emissions, why wouldn't government also be able to cut the cap faster in response to forest plantings that reduce net emissions? Why can the cap be cut faster, to ensure that stupid EV subsidies wind up having an effect on net emissions, but can't be cut faster to ensure that forest planting helps drive faster net emission reduction?

I prefer setting a total volume of credits that the government is prepared to issue between now and 2050, so the binding cap becomes even more binding. But nobody has set that yet. And if your big worry about tree-planting is that lower ETS prices mean that bad people with bad cars drive them more, because ETS credits are cheaper, then you could set that total volume while thinking about the likely volume of forestry credits that are likely to be generated right?

Is there any good reason why the ETS cap can be sensitive to regulations affecting to covered sector but can't be sensitive to forest planting?

Afternoon roundup

The worthies on the closing of the browser tabs:

- A database of global film subsidies. Remember that the only winning move is not to play.

- "Somewhat perversely, some local councils and contractors are putting workers back on the shovel, because that way they can get Ministry of Social Development funding to train up six workers – whereas using a diesel excavator would train only one person."

- The latest Neumark metastudy on minimum wages.

- Can't kill a zombie stat. RNZ repeats the dodgy BERL alcohol cost number. So does Stuff. Remember: the $7.8b number is just the old dodgy number from over a decade ago, multiplied by GDP growth over the period. That's it. It starts with a dodgy number, then inflates it using a dodgy method that requires that alcohol cost be a constant fraction of GDP. Me on this in the Dom, a couple years ago.

- Looks like there are going to be delays to any NZ sanctions regime on Russian-held assets. I really don't know why we have an Overseas Investment Office if they can't even figure out how to do this.

- Lots of NZ kids don't really know how to write or do math.

- Government is subsidising new boilers for some greenhouses and food processors. There is absolutely no need to do this. Process heat is in the ETS.

Friday, 22 April 2022

6.9%

I had a few chats about yesterday's 6.9% inflation result.

Justin Giovanetti from The Spinoff:

Eric Crampton, chief economist at the New Zealand Initiative, says our Reserve Bank has some explaining to do. The bank is responsible for the national economy and, according to Crampton, it owns some of the current situation. When the economy looked like it was going to crash into a deep depression in the first months of Covid-19, the Reserve Bank dusted off its playbook from the global financial crisis and pumped billions into the economy. Within months, it became clear that the economy wasn’t going to crash after all. “This was not the time you want to run the GFC playbook again,” said Crampton.

The bank kept interest rates low for most of the next two years, watching as the housing market soared and unemployment tumbled to a historic low. While that was great for homeowners and workers, it set the dominoes now tumbling in today’s inflation surge.

“It’s going to take a fair bit to get inflation under control. For a long time, New Zealand had one of the most credible inflation targeting regimes in the world. We pioneered it,” said Crampton. Now, he’s not so sure.

“There’s nothing the bank can do about the war in Ukraine or global fuel shocks. The bank should look through that. But because the bank under the current governor has cared about everything under the sun except inflation, it will take time to create credibility that it cares about inflation. The last annual report mentioned climate change more often than inflation.”

NZ Initiative chief economist Eric Crampton said the Government should look at any area that was under substantial supply pressure.

“This would not reduce inflation, but it would reduce cost pressures in areas where there is substantial pressure. How many construction projects that were initiated as part of the shovel-ready projects thing in 2020 never got an adequate cost-benefit analysis – because the point was avoiding a pile of unemployed construction workers – but are still ongoing now, drawing scarce workers and materials into projects that make far less sense than ones that they could otherwise be employed in?”

Direct the Reserve Bank to tackle inflation only

Since 2018, the Reserve Bank has had a dual mandate, to consider both employment and inflation when setting the official cash rate.

Crampton said that could be changed back to a single mandate to focus on inflation.

“Inflation will be worse and fighting inflation will be harder where the Reserve Bank has lost some of its credibility. Moving sharply to restore that credibility will reduce inflation expectations, make it less likely that current high inflation beds in, and make it less costly for the country to get back to normal inflation.”

Address ‘red tape’

The need to keep up with regulations is often blamed for higher prices.

Crampton said the Government could look at regulatory structures that made things hard when supply chains were under pressure.

”Again, this does not reduce inflation, but could reduce overall price levels in those areas. Simplest and most obvious example: building materials. Councils facing joint and several liability are highly reluctant to sign off on any material that they’re not familiar with. That means that if the materials they are familiar with start being scarce, it’s darned hard to shift around. We could take councils out of joint and several liability, so they wouldn’t be so nervous about sign-offs.

“We are going to get hammered yet by the supply shocks coming out of Ukraine and Shanghai. Resilience against global upheaval requires flexibility so that if things go pear-shaped in one spot, we can draw in comparable supply from elsewhere.”

...

Crampton said easing the regulatory barriers that stopped some migrants already here from working would also help.

“How many doctors could start working in our health system if the ridiculous barriers to their working here were eased?”

...

But Crampton said the Government should consider inflation-adjusting the tax brackets.

Because the marginal tax rates apply from set income levels, more people move into higher tax brackets as incomes rise, even if inflation means they are not actually better off. The rates have not been moved since 2010 and now even people earning minimum wage are approaching the middle tax bands.

“It’s dumb to consider this a tax cut. It’s preventing a tax increase by stealth. If the Government wants more money, it should have to go to Parliament for supply rather than just let inflation eventually push everyone into the 33% or 39% tax brackets.

The winner of this contest over who is to blame could end up on the Treasury benches, but Dr Eric Crampton, chief economist at The New Zealand Initiative, thinks both major parties are boxing at shadows.

“The high cost of living in New Zealand has always been a problem, especially around housing,” Crampton said.

“That is not an inflation problem, that is a broken housing market problem and the failure to build enough houses for 20 years.”

...

Crampton said inflation is a global phenomenon, as Reserve Banks around the world have been overly-stimulatory. But no party was ascribing blame in the right direction.

“So far both the Government and the opposition have pointed to all kinds of things other than the Reserve Bank being the ultimate source of inflation,” he said.

“On the Labour side they’ve been pointing to the supermarkets and construction, where they have wanted to do things anyway, as being the problem.

“On the National side, they have pointed to Government spending ... as being the problem.”

But it was Reserve Bank policy which was the problem, he said.

“They have gotten some of their forecasts and policies wrong,” he said. “Everyone had expected very high unemployment outcomes in early 2020 and the Reserve Bank really didn’t update that as quickly as they should have when it became apparently unemployment would not be going through the roof.”

He said he didn’t foresee an outward migration driven by inflation because “inflation is high everywhere”, while the high cost of living, especially around housing, has long been an issue.

“There might be more cause to look to some of the underlying issues which need to be addressed anyway. There are lots of things the Government could be doing to ease price pressures, many of those do not address inflation though.”

Wednesday, 20 April 2022

Extortion shouldn't be a good business model

For decades, newspapers’ business model was simple.Classified ads paid most of the bills. Print ads paid much of the rest. Subscribers paid a bit, sometimes just for the sports section. A few news-hounds demanding in-depth journalism were cross-subsidised by everyone else, including newspaper owners who enjoyed the prestige.That model is long gone. Classified ads fled online in the 2000s. Companies wanting to advertise have a broader and better targeted set of online options. And a small number of infovores willing to pay for rigorous journalism has a hard time covering the cost.There have been many experiments in finding better models but the most unfortunate recent gambit is, at its heart, an extortion racket.Australia’s News Media Bargaining Code can compel online platforms to bargain with new sites, under threat of final offer arbitration. Simply linking to a newspaper’s website can there lead to compelled payment.This week, the Commerce Commission granted preliminary authorisation for New Zealand’s media companies to launch their own collective bargaining efforts with online platforms.But bargaining seems the wrong word when any negotiations will fall under the shadow of potential regulation or compulsion if the government does not like the results. Extortion may be more accurate.The whole approach is misguided.The web is built on links. Any website can link to any other website, can choose to set a subscription paywall, and can decide to block search engines from indexing their site.Coercing payments for links breaks fundamental principles of the web.Doing so when Sapere’s report for the Ministry of Culture and Heritage, released in February, concluded that “digital platforms provide considerable commercial benefits to news firms” is absurd.No principle of public economics justifies taxing platforms like Google and Facebook to subsidise news.If you think that web platforms are undertaxed, support multilateral efforts around tidying tax on multinationals – but you may find that plenty of tax is already being paid.If you think that good journalism deserves better funding, contribute to it and encourage others to do likewise. If that isn’t enough to support the public goods provided by rigorous journalism, look at measures like the public interest journalism fund.But extorting web platforms to pay for journalism is worse than taxing hipsters’ beard oil to fund tīeke recovery. It breaks principles of good tax policy and foundational principles of the web.Viable business models should not rely on extortion.

Morning roundup

The morning's worthies.

R0 on tabs is high.

- Matt Nolan provides a coherent critique of the government's unemployment insurance scheme from the left. Simon Chapple suggests leveraging off KiwiSaver for short-term consumption smoothing.

- The MoH advice was to end MIQ back in November. I would have disagreed with that advice. But it's interesting because those of us pitching ways of strengthening safety while enabling more travel were always cast as death merchants by those wanting to canonise Bloomfield.

- They told us that there are no slippery slopes. Now they want a new advertising code of ethics "to end the promotion of high-carbon lifestyles and products." It is barking mad, and it has Julie Anne Genter's support.

- Against genetic denialism

- The odds of an inflation disaster are rising.

- The negative supply shock worsens.

- Richard Prebble is right. The Reserve Bank of New Zealand cannot be trusted under its current mandate.

- Oregon's legalisation of psilocybin therapy ... it's going to be an expensive trip.

- Fairly large investment in solar generation coming for NZ. Remember that NZ's able to make this work without subsidising solar. Just taxes on carbon and a so-far clean electricity market.

- Last week, David Clark was threatening the supermarkets. This week, Grant Robertson did at the post-Cabinet briefing - check the 16:30 mark where he notes they're still considering going further than the ComCom recommendations - like "separation of some of the entities involved". Robertson wanted inflation, or didn't care about stopping it. And now he needs a scapegoat.

- ProdComm put out a report last week encouraging fixing NZ's dumb bans on genetic engineering. Reporting has been positive (RNZ, Newsroom, BusinessDesk). Fingers crossed.

- Thomas Coughlan works through the timeline on MoH "consolidating" RATs.

- The new Transmission Pricing Methodology aims to remove first-mover disadvantage by only charging a transmission customer for the capital cost of the capacity that they need, not the full capacity that gets built when a new bigger line is put in. Effectively that will mean that the lines company bears the risk if it overestimates follow-on demand. They're probably better placed to bear that risk.

- Peter Griffin on fintech developments in NZ. I'm going to have to catch up on this stuff.

Tuesday, 19 April 2022

Levels, rates, and supermarket prices

Here's Minister Clark's release:

Latest annual food price figures released today confirm the need to rein in the super profits of the supermarket duopoly, Commerce and Consumer Affairs Minister David Clark said.

Today’s food price index figures show an annual increase of 7.6 percent in March 2022 compared to March 2021. This is the largest increase since the year ended July 2011 when prices increased 7.9 percent, partly influenced by the National Government increasing GST from 12.5% to 15%.

“The March increase is above general inflation figures and highlights the role the grocery sector is playing in driving up prices,” David Clark said.

“Rising food prices is a global issue. Omicron, ongoing disruptions to global supply chains and Russia’s invasion of Ukraine is putting pressure on prices in every country, but that is exacerbated here by the lack of competition at the checkout. And that is something we can act on.

“Today’s figures confirm the findings in the Commerce Commission’s grocery market study that the supermarket duopoly is making profits at the expense of everyday New Zealanders.

He goes on to note that he hasn't "ruled out going further than the options that the Commission tabled in its final report."

There are a few problems here.

First, rates of food price increases can't tell you much about the need for antitrust action, unless there's been some underlying change in the market structure.

In the standard linear model, a monopolist will pass through less of a cost increase to consumers. In that case, if food prices were rising more quickly than general inflation, the first-cut guess would be that they're passing through more of their cost increases than other sectors. That would be weak evidence against their being monopolistic, not evidence in favour of it. In other models, like with constant elasticity of substitution demand functions, it'll be indeterminate - the extent of pass through will depend on the elasticity that you pick. And again you can't jump from 'their rate of price increase is higher than other sectors' to 'they need antitrust'. You'd need to do more work.

If there'd just been a giant merger between the two supermarket chains and food prices started going up by a lot more than they had previously, and relative to other prices, then that would be worth looking into. It wouldn't at all be crazy to think that the change in market structure had done something. But where the market structure has been constant, it's going to be tough to blame it for changes in the rate of price increase.

Second, the March quarter CPI figures aren't even out yet. When Clark talks about general inflation figures, he's talking about December quarter 2021. He has to be, unless he's had early access as Stats Minister to the March quarter CPI figures - which is far far far less likely. And in that December 2021 quarter, the annual price increase in food was less than the annual price increase in CPI more generally - as had been the case in 70% of quarters over the past decade.

Some of the problem here comes down to inability to think through the difference between levels and rates.

Monopolies result in high levels of prices - higher than they should be. But that has no necessary effect on the rate of price increases. On a first cut you should expect monopolies to be less responsive to changes in costs than competitive players, but it's complicated.

It's true that improved competition in grocery retail and getting rid of government-imposed barriers to entry (zoning, consenting, overseas investment act) should reduce the level of grocery prices.

I'm not sure that anyone in the country has pushed harder than I have for liberalising land use planning, consenting, and the overseas investment act to enable more entry.

But doing so won't reduce inflation. It will cause a level shift downwards in the CPI relative to the counterfactual, and the path to that new and lower path for the CPI might take a little while. You'd then expect CPI growth to be lower than otherwise until you're at the new path, and CPI to resume its prior rate of price increase after that.

There's plenty of harms from the government-imposed barriers to entry that result in less competition than might be desirable. Higher overall prices are one. Clark's blaming the supermarkets for rising CPI is just wrong.

A snippet from the column:

Clark suggested that food prices rising ahead of the overall Consumer Price Index justifies anti-trust action in groceries.

Over the past decade, annualised food price inflation has been below overall consumer price inflation in 28 out of 40 quarters – 70 per cent of the past decade. Should we then ignore the Commerce Commission’s recommendation to liberalise zoning and land use planning so that more supermarkets can enter the market?

I hope not.

Even worse, Clark implicitly compared March quarter food price figures with December quarter CPI figures. March quarter inflation figures will not be released until later this week. It is currently impossible to say whether food price inflation is above or below the overall CPI.

The most recent inflation figures are from the December quarter. In that quarter, year-on-year food price inflation was 1.8 percentage points below the overall CPI.

So the Minister was wrong about the most recent possible comparison between food price inflation and overall inflation, and did not know or ignored the trend over the past decade.

It gets dumber still.

Suppose that New Zealand had a single monopoly grocer covering the entire market with no competition at all, instead of two chains with many fringe competitors.

That monopolist would be very profitable.

But would it use inflationary conditions as opportunity to hike prices even more? In other words, does inflation enable a monopolist to become even more greedy?

Not really. The standard case suggests the opposite.

Monopolists are generally bad for consumers. But a monopolist is generally less responsive to changes in costs.

The standard simple example taught in intermediate microeconomics texts has a monopolist passing through half of a cost increase to consumers rather than the full amount.

Monopolists charge too high a price to begin with, relative to a competitive market benchmark. Fully passing cost increases through to consumers would mean lower profits because of reductions in turnover.

That is why only 7 per cent of US economists surveyed in January, in response to similar populist nonsense there, agreed that market power is a significant factor in explaining inflation. Only 5 per cent agreed that antitrust interventions could successfully reduce inflation over the next year.

Harvard’s Eric Maskin provided the standard answer: “Theory suggests that monopolists respond less to changes in costs than pure competitors do, so market power doesn’t seem a likely culprit.”

So Clark was wrong in stating that food price increases have outstripped inflation. Inflation data for the most recent quarter has not even been released yet, and overall inflation in the December quarter ran hotter than food price inflation.

Even if he had been right about food price inflation exceeding CPI in the most recent quarter, he would have been wrong about the overall trend over the past decade.

And if food prices had outpaced inflation over the past decade, that would be weak evidence against the need for increased competition in grocery retail, not justification for greater intervention.

In short, the minister was wrong from beginning to end. Absolute economic ignorance would be the most charitable explanation, but even then he might have considered asking Treasury’s advice.

More plausibly, Clark was scapegoating the supermarkets to justify populist measures against them, or to deflect attention from his government’s failure to keep the Reserve Bank on target, or both.

We are going to get so much more stupidity fuelled by high inflation rates.

Getting Easter out of the Asylum

ACT's Chris Baillie has a Member's Bill up to remove the Easter trading restrictions. Good!

“Our antiquated Easter trading laws are ready for an overhaul and the Government needs to adopt my Member’s Bill to do just that,” says ACT's Small Business spokesperson Chris Baillie.

“As a small business owner, I know the pain that many businesses feel when they’re forced to close over Easter or enforce silly rules around whether adults can have a pint with lunch.

“My Member’s Bill will remove the extra burden on businesses by relieving the idiotic restrictions on trading on Good Friday and Easter Sunday.

“It’s quite simple – if you want to trade, you can. That’s how a free society should operate. The Bill also looks after workers as it retains the existing employee protections that apply in respect of Easter Sunday and extends these protections to Good Friday.

“It just doesn’t make sense that bar staff spend much of Easter telling customers when they can drink, how long they have to drink it, how much they are required to eat, and what they have to eat. How about we start treating adults like adults?

“At my restaurant and bar in Nelson, our staff have to lecture adults about how they can have a glass of wine with a salad but not with a bowl of fries. It’s madness.

“We’ve just opened our borders up to the first wave of Australian tourists in years. We should be encouraging them to get out and spend as much of their money in our bars and restaurants as possible. Our hospitality sector deserves it.

“Pushing the enforcement of the law down to local councils is weak and a waste of their time. We should simply scrap the laws and stop forcing councils to waste their time trying to punish businesses simply trying to turn a profit.

“ACT has employers’ backs and knows that owning and running a business is hard work and high risk. Let’s be sensible and create laws which allow businesses to thrive, not add unnecessary pressure and regulations.”

I hope the Bill is drawn from the biscuit tin. And I hope that any objections to it are resolved by making Easter a statutory holiday while eliminating the trading bans. Easter currently isn't a stat holiday. So while workers can refuse to work that day, those who do don't get holiday pay or time-in-lieu unless that's provided in their employment contract. I'm perfectly happy to rely on employment contracts alone to sort this out, but Easter as a stat makes more sense than trading bans as employee-protection.

Previously: A compromise to get Easter out of the Asylum

Wednesday, 13 April 2022

Another occupational licensing cartel

Before the last election, Shane Jones set a new regulatory regime around forestry. It's now coming into effect. I'd forgotten about it.

Roger Partridge wrote about it back in 2020. It was a disaster both in content and in process.

However, Jones has decided the industry can't fend for itself and needs an extra dose of regulation. Yet his actions suggest the industry's interests are not his main priority. His innocuous sounding Forests (Regulation of Log Traders and Forestry Advisers) Amendment Bill will sacrifice the interests of forest owners – among them North Island iwi owners – in favour of utopian plans for an enhanced domestic wood processing sector, which Jones hopes will boost employment, especially in his homeland in the Far North.

The Bill was introduced into Parliament under urgency on May 14. Indeed, Jones was in such a hurry that he gave the industry only a week to provide submissions to the Select Committee considering the Bill. (And for reasons best known to the Minister, the Environment Select Committee has been tasked with evaluating the Bill, not the better qualified Primary Production Select Committee.)

The Ministry for Primary Industry's Regulatory Impact Statement on the Bill was only made available to submitters two days before the date of submissions closed. This haste would be unacceptable in an advanced democracy like New Zealand, even if all the Bill did was set out an occupational licensing regime to ensure log traders and forestry advisers are "fit and proper people" – which is the Bill's ostensible purpose.

...

The RIS reveals serious shortcomings even with the Bill's more modest occupational licensing objective. The evidence relied on to support the proposed occupational licensing regime is described in the RIS as "qualitative," but it is clearly only anecdotal. Indeed, the RIS acknowledges shortcomings in the evidence available to define the magnitude of the problem faced by small forest owners arising from "time constraints on the policy development process."

This would be concerning enough if all the Bill proposed was an occupational licensing regime. It is in no one's interest for a regulatory regime to be introduced without a proper evidence base.

But the bigger problem lies with the more ambitious, unevaluated regulatory provisions of the Bill supporting the Minister's lofty plans for promoting "an enhanced domestic wood processing sector." The Minister's failure to subject these provisions to proper assessment – or to even raise them in his Cabinet Paper – shows a concerning disregard for due process.

Despite the lack of any decent evidence that an occupational licensing regime is needed for log trading, we're getting a new occupational licensing regime around log trading.

This morning's inbox brings a reminder that this mess is now coming into force.

In August 2020, Parliament enacted the Forests (Log Traders and Forestry Advisers) Amendment Act. The Amendment Act (which was grandfathered under the Forests Act 1949 – presumably to speed its implementation pathway) provides a new regime for log traders and forestry advisers to be registered and subject to certain professional standards.

That new regime is to operate from 6 August 2022.

From 6 August 2022, there is a one-year transition period for log traders and forestry advisers to get registered before penalties will apply.

Public consultation on the proposed registration system closed in January and MPI is currently working on (and seeking feedback about) the new registration system.

The new regime introduces a professional compliance (aka occupational licensing) regime on a previously unregulated part of the forestry sector.

The regime came about as a sort of kneejerk reaction from public discussion about the high proportion of raw logs which were being directly exported – and the concern that this was leaving a lower proportion of logs available for processing in New Zealand sawmills and/or impacting on the domestic lumber price.

This background is reflected in the stated purpose of the Amendment Act:

The Amendment Act seeks to achieve this purpose by introducing an occupational licensing and compliance regime for log traders and advisors operating in the forestry sector. This seems to be despite the fact that the captured activities operate in a commercial or business context – and not at a consumer or retail level. Amongst other things this seems rather puzzling - and arises the concern that, perhaps rather like the RMA, it will be used as a sword and not a shield by those (in trade) seeking some sort of commercial advantage over their rivals.

Captured activities – log traders

The Amendment Act seeks to capture the activities of ‘log traders’, being a person in trade who:

• buys New Zealand logs, whether after harvest or in the form of trees to be harvested at an agreed time, and whether or not the person intends to on-sell the logs; or

• exports New Zealand logs; or

• processes New Zealand logs that the person has grown themselves,

and includes a person who does any of these things as the agent for another person:

(Also captured is a company that, in trade, transfers the ownership of New Zealand logs to or from a related company, whether the transfer relates to logs after harvest or in the form of trees to be harvested at an agreed time).

There is a prescribed volume threshold of 2,000m3 of New Zealand logs per year.

Businesses involved in shipping and logistics are not caught by the Amendment Act.

Forestry adviser service

The Amendment Act also captures ‘forestry advisor services’.

This is defined as someone who, in the ordinary course of business, provides advice on:

• the establishment, management, or protection of a forest;

• the management or protection of land used, or intended to be used, for any purpose in connection with a forest or proposed forest;

• the appraisal, harvest, sale, or utilisation of timber or other forest produce;

• the appraisal of a forest, forest land, or other forestry sector assets;

• the application of the emissions trading scheme to forestry activities (within the meaning of the Climate Change Response Act 2002); or

• the beneficial effects of forests (including, for example, how they contribute to environmental and economic outcomes).

(Also captured are those acting on behalf of others in relation to their sale or purchase of timber or other forest produce).

However, the Amendment Act does not cover the provision of advice, in a professional capacity, by those professional advisers who are already regulated by another professional body (e.g. real estate agents, financial advisors, lawyers and accountants).

Compliance and reporting standards

Those who are required to register as:

• a log trader; or

• a forestry advisor,

will need to satisfy the Forestry Authority (under the umbrella of MPI) that they meet the ‘fit and proper person’ standard.

They may also have to provide evidence of their qualifications and experience in the forestry and wood processing sector – (the details of this requirement is s till being developed by MPI).

Once registered, log traders and forestry advisors will be subject to ongoing compliance, reporting and record keeping obligations.

A disputes (complaints) body is also established under the Amendment Act to hear and administer complaints.

Standard setting

The Forestry Authority has the power to set standards for any matter relating to forestry operations and delivery of forestry advisor services including:

• land preparation, planting, forest management, harvest planning and site preparation and valuation;

• biosecurity, sustainable land use, biodiversity and emissions trading;

• sale and purchase agreements for domestic transactions or exports; and

• other sale and purchase requirements.

However, the rule-making power must not impose any condition or requirement which would be a matter for commercial agreement between parties.

Code of ethics

The Forestry Authority may make rules that set a code of ethics for registered forestry advisers.

The code of ethics may include matters relating to:

• professional responsibility (maintaining the highest standards of integrity and technical accuracy); and

• responsibility to clients (including issues of confidence and conflicts of interest); and

• professional work standards by registered forestry advisers in employment; and

• maintaining professional competency.

Penalties

Penalties for non-compliance with the occupational licensing and compliance regimes established under the Amendment Act provided for fines of up to $40,000 for individuals and up to $100,000 for companies.

Timeline

Te Uru Rākau – New Zealand Forest Service (part of MPI) is working on a registration system which is due to come into force on 6 August 2022. Under the Amendment Act, log traders and forestry advisers must register to operate from this date.

That is, from 6 August 2022, there is a one-year transition period for log traders and forestry advisers to get registered before penalties will apply.

Afternoon roundup

A closing of some the browser tabs brings a few worthies:

- Roland Fryer Was Railroaded

- Brian Easton on the perils of ignoring economics

- Pay for defection. It raises the cost of attacking.

- The Canadians get stuck with a copyright term extension. Cosh is excellent here. Why does the Canadian government figure it can ignore the dairy provisions in trade agreements but bound by dumb copyright stuff?

- The extortion attempt continues. [Me on this, previously]

- Ontario's Housing Affordability Taskforce report from February has a lot of good stuff. I'll need to read through it more carefully. Looks like Ford won't be implementing it but there are ideas worth thinking through for NZ.

- Superb BusinessDesk piece on the cost of building infrastructure in NZ. I wish Auckland could outsource both construction and all of the approvals for its transport/infrastructure projects to whoever sorts that out in Seoul.

- Liberal Education

- Ages back, Hess & Orphanides found that discretionary wars were more likely for first term Presidents presiding over poor economic conditions. Simple little model. Re-election depends on demonstrating competence, two margins for demonstrating it, if you've failed at the one worth the punt on the other. Ashani Amarasinghe has a forthcoming piece at J. Pub that's far more extensive. Lots of governments aim to distract from domestic turmoil. But it doesn't work all that well.

If we're going to have an embassy in Moscow...

If we aren't using our embassy in Moscow for granting asylum paperwork and visas for Russian dissidents, we might as well expel the Russian ambassador and staff and recall our own.

The main benefit of suffering their continued presence here is that it lets us keep an embassy there.

So use it for what it's good for: draining Russia of talent, to the benefit of dissidents seeking freedom, and to the benefit of NZ as a whole.

Trade sanctions aren't going to do much; NZ hasn't got a lot of trade with Russia. And the 35% tariffs are a joke in any case. The NZ government put 110% tariffs on some wire nails from a company in China that the NZ government considered to be undercutting local manufacturers. So as far as the NZ government is concerned, as expressed in tariff policy, undercutting local manufacturers is worse than invading Ukraine and murdering tens of thousands of civilians. Seems pretty typical really.

But tariffs and trade embargoes hurt both sides. Well designed ones hurt the other side more, but they'll always hurt at least somewhat. Letting people move here though? That doesn't hurt at all. We have labour shortages all over the place.

My column in Newsroom, now ungated:

Tariffs and trade sanctions are important, but costly. They hurt both sides. But welcoming skilled workers and depriving Russia and Belarus of highly skilled labour, as Orrell and Nowrasteh put it, “would strike a blow against our adversaries and simultaneously strengthen the present – and future – American economy.”

They noted that some 50,000 to 70,000 information technology specialists had fled Russia since the war started, and another 100,000 were expected to leave by the end of April.

The Soviet Bloc knew the risks a brain drain posed to their regime and built a concrete wall to stop it. Today’s wall is built of paper: immigration restrictions in New Zealand and elsewhere prevent entry.

Tuesday, 12 April 2022

Market studies and professional services

Aaron Edlin and Rebecca Haw Allensworth's warning about professional services and antitrust in America applies just as strongly in New Zealand.

The great accomplishment of the Sherman Act has been to make cartels per se illegal and relatively scarce. Unless the cartel is managed by a professional licensing board. Most jurisdictions consider such boards, as creations of states, to be exempted from antitrust scrutiny by the state action doctrine, leaving would-be competitors and consumers no recourse against their cartel activity.

We contend that the state action doctrine should not prevent antitrust suits against state licensing boards that are composed of private competitors deputized to regulate their own competition and to outright exclude those who compete with them, often with the threat of criminal sanction. At most, state action should immunize licensing boards from the per se rule and require plaintiffs to prove their case under the rule of reason. We argue that the Fourth Circuit’s recent case upholding an FTC antitrust suit against a licensing board — creating a circuit split and becoming the only circuit to deny state action immunity to a licensing board — is a step in the right direction but not far enough. The Supreme Court should take the split as an opportunity to clarify that when competitors hold the reins to their own competition, they must answer to Senator Sherman.

The state action doctrine in the US is the NZ's Commerce Act exemption for statutory regimes. The general proposition is that things authorised by Parliament or the Legislature cannot be bad.

The Sherman Act has had one principal success: cartels and their smokefilled rooms, where competitors agree to waste economic resources for their own industry’s benefit, are unambiguously and uncontroversially illegal in the United States2 --unless that industry is a profession and that cartel is a state licensing board. Although often overlooked, licensing boards have become a massive exception to the Act’s ban on cartels.

Licensing boards are largely dominated by active members of their respective industries who meet to agree on ways to limit the entry of new competitors.3 Some boards use their power to limit price competition or restrict the quantity of services available.4 But professional boards, unlike cartels in commodities or consumer products, are sanctioned by the state--even considered part of the state5 --and so are often assumed to operate outside the reach of the Sherman Act under a line of Supreme Court cases starting with Parker v. Brown. 6

NZ is behind the US in regulating professions, but it's getting worse here. The doctors have been an obvious cartel for a while - there is no better explanation for their restrictions on entry. The Commerce Commission really should use its market studies powers to check into these.

The problem is growing.

Insolvency practitioners a little while back.

The Employment Law Institute of New Zealand has raised the issue of unregulated advocates with the Government on multiple occasions. Representatives met with then-Minister for Justice Andrew Little in August 2020 and then again with Minister of Workplace Relations Michael Wood in May 2021.

But Coley thinks more urgent action should be taken. She believes people have suffered “psychological and reputational damage” as a result of poor legal representation, or they might be led to believe they have a strong case when really there’s not a foot to stand on.

“I pick up files myself where someone's been really poorly represented,” Coley says.

“It's very hard to fix some of the damage that some unregulated advocates are doing, particularly where there's an ongoing employment relationship.”

Rather than turn the profession into a cartel, why not allow judges to award damages a little differently?

Suppose you're represented by a dodgy advocate who doesn't know what he's doing and is just ramping up the costs for everybody in a hopeless case.

The judge can award costs and require that you pay your employer's legal bills for the mess, but people in that spot are often judgment-proof.

Why not make the advocate liable for costs too? If they're behaving in ways so egregious that they'd be struck off by a cartel licensing board, the judge will surely notice. The judge could require that the advocate cover costs on both sides.

You then have a strong mechanism punishing incompetence, without turning the profession into a cartel.

Friday, 8 April 2022

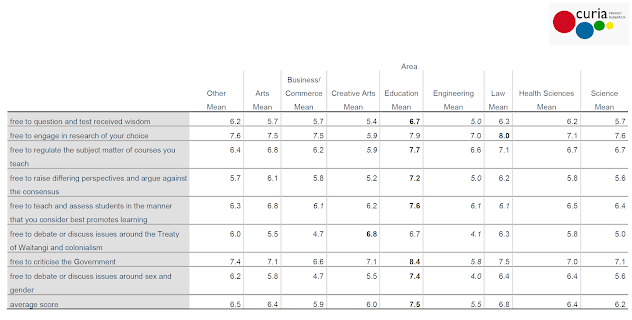

Academic freedom - survey says

Here are the results from a straightforward OLS with the principal component from the factor analysis over on the left hand side, and the kitchen sink on the right hand side. T-stats below coefficients; stars mean their usual thing.

| Principal Component | |

| Institution | |

| Victoria University of Wellington | |

| (Reference category) | |

| Otago University | -0.335 |

| (3.42)** | |

| AUT | -0.516 |

| (4.12)** | |

| Massey University | -0.380 |

| (3.81)** | |

| University of Canterbury | -0.141 |

| (1.33) | |

| Auckland University | -0.262 |

| (2.51)* | |

| University of Waikato | -0.336 |

| (2.74)** | |

| Gender | |

| Male | |

| (Reference Category) | |

| Female | -0.103 |

| (1.61) | |

| Gender Diverse | 0.542 |

| (1.90) | |

| Field of Study | |

| Arts | |

| (Reference category) | |

| Business | -0.256 |

| (2.33)* | |

| Creative Arts | -0.272 |

| (1.36) | |

| Education | 0.384 |

| (2.63)** | |

| Engineering | -0.487 |

| (3.51)** | |

| Health Sciences | 0.104 |

| (0.97) | |

| Laws | 0.002 |

| (0.01) | |

| Science | -0.123 |

| (1.23) | |

| Other Area | -0.060 |

| (0.48) | |

| Rank | |

| Lecturer | 0.192 |

| (1.78) | |

| Senior Lecturer | |

| (Reference Category) | |

| Ass. Prof | -0.099 |

| (1.15) | |

| Prof | 0.160 |

| (1.93) | |

| Senior Management | 0.145 |

| (1.01) | |

| Other | -0.091 |

| (0.82) | |

| Age | |

| Under 30 | 0.314 |

| (1.77) | |

| 31-45 | |

| (Reference Category) | |

| 46-64 | -0.315 |

| (4.27)** | |

| 65+ | -0.171 |

| (1.89) | |

| Constant | 0.504 |

| (4.27)** | |

| R2 | 0.10 |

| N | 1178 |

Scurvy Dogs?

Dogs don't get scurvy. Guinea pigs do. And polar bears are more like lemons than limes are like lemons, on one important margin.

A fun imagined dialogue, where Forlich is right, but looks completely crazy, because reality can be weird.

Let’s imagine a version of history where the guinea pigs did indeed get lost in the Norwegian mail, so Holst and Frolich only tested dogs, and found no sign of scurvy. Let’s further imagine that Frolich has been struck by inspiration, and through pure intuition has figured out exactly what is going on.

—

Frolich: You know Holst, I think old James Lind was right. I think scurvy really is a disease of deficiency, that there’s something in citrus fruits and cabbages that the human body needs, and that you can’t go too long without.

Holst: Frolich, what are you talking about? That doesn’t make any sense.

Frolich: No, I think it makes very good sense. People who have scurvy and eat citrus, or potatoes, or many other foods, are always cured.

Holst: Look, we know that can’t be right. George Nares had plenty of lime juice when he led his expedition to the North Pole, but they all got scurvy in a couple weeks. The same thing happened in the Expedition to Franz-Josef Land in 1894. They had high-quality lime juice, everyone took their doses, but everyone got scurvy. It can’t be citrus.

Frolich: Maybe some citrus fruits contain the antiscorbutic [scurvy-curing] property and others don’t. Maybe the British Royal Navy used one kind of lime back when Lind did his research but gave a different kind of lime to Nares and the others on their Arctic expeditions. Or maybe they did something to the lime juice that removed the antiscorbutic property. Maybe they boiled it, or ran it through copper piping or something, and that ruined it.

Holst: Two different kinds of limes? Frolich, you gotta get a hold of yourself. Besides, the polar explorers found that fresh meat also cures scurvy. They would kill a polar bear or some seals, have the meat for dinner, and then they would be fine. You expect me to believe that this antiscorbutic property is found in both polar bear meat AND some kinds of citrus fruits, but not in other kinds of citrus?

Frolich: You have to agree that it’s possible. Why can’t the property be in some foods and not others?

Holst: It’s possible, but it seems really unlikely. Different varieties of limes are way more similar to one another than they are to polar bear meat. I guess what you describe fits the evidence, but it really sounds like you made it up just to save your favorite theory.

Frolich: Look, it’s still consistent with what we know. It would also explain why Lind says that citrus cures scurvy, even though it clearly didn’t cure scurvy in the polar expeditions. All you need is different kinds of citrus, or something in the preparation that ruined it — or both!

Holst: What about our research? We fed those dogs nothing but grain for weeks. They didn’t like it, but they didn’t get scurvy. We know that grain isn’t enough to keep sailors from getting scurvy, so if scurvy is about not getting enough of something in your diet, those dogs should have gotten scurvy too.

Frolich: Maybe only a few kinds of animals need the antiscorbutic property in their food. Maybe humans need it, but dogs don’t. I bet if those guinea pigs hadn’t gotten lost in the mail, and we had run our study on guinea pigs instead of dogs, the guinea pigs would have developed scurvy.

Holst: Let me get this straight, you think there’s this magical ingredient, totally essential to human life, but other animals don’t need it at all? That we would have seen something entirely different if we had used guinea pigs or rats or squirrels or bats or beavers?

Frolich: Yeah basically. I bet most animals don’t need this “ingredient”, but humans do, and maybe a few others. So we won’t see scurvy in our studies unless we happen to choose the right animal, and we just picked the wrong animal when we decided to study dogs. If we had gotten those guinea pigs, things would have turned out different.

Thursday, 7 April 2022

Council carbon counsel

Me in today's Herald, on Council initiatives to reduce carbon emissions:

Inflation being central government's responsibility hardly means that local councils can just ignore it. Inflation affects everyone: households, companies, and councils. A council that ignored inflation would lose good staff by failing to keep up with wage increases, err in estimating project costs, and blow out budgets.

A superb council could help its residents by making sure its rules do not make it too hard for residents to adapt to rising prices. Easing zoning and consenting would help housing supply to respond to changes in demand, making the Reserve Bank's job easier, while improving housing affordability.

But it would be madness for a council to take on an anti-inflation mandate and try to combat inflation directly through local wage and price controls.

It would be worse than counterproductive.

The same is true for council-level policies for dealing with carbon emissions.

There's lots that councils should be thinking about. Resident demands for all kinds of stuff will change with rising carbon prices. But councils trying to target emissions, rather than respond to expected carbon prices, get things backwards.

There is risk that councils take climate consenting tools and use them to block housing in places under NIMBY pressure. A lot of the tools that Councils use to block urban growth have been being taken off them by central government; they'll pick up new tools like costly green-building mandates if they can.

In Monday's Dom Post, I noted Canada's carbon dividend. It was lovely seeing Canada's Environment Minister remind everyone about the carbon dividend that would make 8 out of 10 households better off from his carbon tax increase.

And went through again the case for carbon prices and carbon dividends, while still trying to disabuse people of some very serious widespread misunderstandings of what's going on in one bit of the Climate Commission's modelling.

Economists tend to prefer relying on the Emissions Trading Scheme in the first instance and using other policies only when they address specific additional market failures.

Section 6.3 of the Commission’s report models what would happen under a $50 carbon price within the sectors currently covered by the ETS, if there were no restrictions on forestry conversions prior to 2050.

It shows that New Zealand can reach Net Zero by 2050 at the relatively low carbon price of $50/tonne. After 2050, there would be an increase in net emissions by 2065 “if there were no further forestry planting or policy changes.”

Many commentators have taken this section as suggesting that relying on the ETS would fail because of an increase in net emissions after 2050. Olivia Wannan notes that following that scenario “would violate the [Zero Carbon] Act, which requires all budgets after 2050 to also achieve net zero.”

But the scenario is simply a demonstration of the effects of a $50 carbon price in the sectors covered by the ETS. The modelling does not include the ETS’s cap on net emissions, and it does not allow carbon prices to change.

Wednesday, 6 April 2022

Afternoon roundup

The closing of the browser tabs:

- The Niskanen Center goes through the problems with intellectual property. They remind that independent re-discovery needs to be allowed; I take it as meta-point that they mention Landes & Posner nowhere in the piece, which re-derives much of the Landes & Posner framework in different terms.

- Things have gotten really bad in US academia. (ungated link)

- The latest John Lott mess

- The case for an Australian carbon tax and dividend

- I don't know if Google's new language model can think, but it can run logical inference.

- Larry Summers chats with Ezra Klein on inflation

- The Infrastructure Commission's report on the housing crisis is excellent. I'd threaded the key figures here.

Tuesday, 5 April 2022

Wellington hates economists?

Auckland University's Robert MacCulloch says that Wellington hates economists. I worry he's an optimist.

Robert's starkest example is the absence of monetary policy expertise on the Monetary Policy Committee. It was viewed as a conflict of interest.

It points to how things are perhaps even worse.

There are more than a few people employed in the public sector with the job title "economist" who have very poor training and whose main job is putting sciency-sounding words around things they think the Minister wants to do anyway.

Real monetary policy experts would be a challenge on the Monetary Policy Committee.

Real economists elsewhere in the Ministries would also be a challenge.

Basically, if you learn to say "Market failure justifies what my Minister wants" or "Amartya Sen shows that the Minister is right; he is nuanced, unlike those market fundamentalists who oppose the wishes of our enlightened Minister", or "We need to listen to more non-neoclassical non-neoliberal thinkers like Raworth and Mazzucato", you'll go far in economics roles in too much of the NZ public service.

Monday, 4 April 2022

How to RUC

Minister of Transport Michael Wood said he and officials were aware of the financial risk for transport coffers, if too much “stocking up” occurred.

“I don’t think many people will look to do that, but we do want to make sure there is some integrity built into the system,” Wood said.

Wood would not disclose exactly how RUC purchases would be controlled when the discount kicked in.

“Primarily, it would be about Waka Kotahi having the ability to audit and check after purchases have been made,” he said.

“We’d be looking at what is potentially excessive and unreasonable purchasing.

“If you have someone who purchased 5000 kilometres every three months, and suddenly they were wanting to purchase 25,000, that would obviously be an alarm bell, and we’d be wanting to empower Waka Kotahi to be able to deal with that situation.”

Audit and check what - that kilometres purchased were driven during the allotted time? They'll then need a mechanism for running odometer checks at either end of the discount period.

Why both sides of the allotted time? Because people will be using expensive previously-purchased RUC during the discount period, and you'll need to weigh that up. If I purchase 50,000 km at the start of the period and wind up with 40,000 km unused at the end of the period, I could claim that I actually put on 50,000 km during the period - I'd just had a lot of km that had been sitting there unused at the start of the period.

That sounds extreme, but I right now have about 5,000 km of RUC pre-purchased. I've 7,000 km on the odometer and RUC purchased to get me to 12,000 km. If I buy 5,000 km during the period and, at the end of the period, my odometer's at 12,000 km with RUC purchased up to the 17,000 km mark, that isn't me gouging the system, that's me buying a quantity exactly equal to my RUC consumption during the period. But there's no way of telling whether I actually had 5,000 in the bag ex ante without an odometer check at the start of the period.

Or maybe "to be able to deal with" just means "yeah, they can phone the purchaser up and verify that there's a plausible-sounding story around any higher-than-normal purchase, because enforcing anything in this will be a nightmare unless it's just impossible that the purchase was legit."

It won't be an easy one to get right.

UPDATE: From Newsroom:

Transport Minister Michael Wood told Newsroom those purchasing discounted RUCs would need to “complete an online declaration form stating that they are only purchasing charges that they require for that period’’.

“Waka Kotahi will undertake spot checks of large or suspicious purchases and, where appropriate, take enforcement action.

“Enforcement action could include the charging of unused road user charges at the non-reduced rate,’’ Wood said.

Those diesel users who have charges remaining on their vehicles will also be able to apply for a credit.

“They will be able to purchase what is referred to as an overlap licence. Typically when purchasing a RUC licence, the start distance of that licence will continue from the end of the previous RUC licence.

“However, with an overlap licence, the RUC licence begins from the odometer reading on the date of purchase, with the unused distance automatically credited towards the new licence,’’ Wood said.

Most people who choose this method will have to purchase a top-up for the new licence due to RUCs only being able to be purchased in 1000km units.

“This top-up will be at the discounted rate," Wood told Newsroom.

Legislation will be introduced into the House on Tuesday, and passed under urgency, to allow and enforce these changes ahead of the discount period starting.

So when this comes in, an honest person in my position would apply for the overlap licence, truthfully report the current odometer reading, purchase the amount of RUC they expect to use over the next 3 months, and get a RUC label that combines the amount just purchased with the prior stockpile for a new "paid up until XXXXX km" notice.

A dishonest person would understate their odometer's current position and overstate the amount they were likely to use over the next 3 months, so that their new licence could cover a lot of driving after the three months, or not bother applying for the overlap at all and just hold the new licence.

One fairly simple thing they could do would be to print the discount-period RUC licences on different coloured paper, so there could be some worry that a traffic stop could involve an odometer check if you were still running that permit after the period had lapsed. If your discount-odometer licence had you good through 100,000 km and your odometer only had 20,000 km on it two months after the discount window, it would be pretty obvious that you owed the difference on 80,000 km.

But if the only penalty is that you wind up paying full price for kilometres that you'd have wound up purchasing and using anyway, sometime, it seems a bit of a one-way bet. Heads you get cheaper RUC for a longer period. Tails you get some cheaper RUC, and you've purchased RUC earlier than you might otherwise have for the rest of it. If you win, 1/3 off the cost of a pile of km. If you lose, you've brought forward a bit of spend - and that could matter a bit if RUC doesn't move up with inflation as quickly as it should.

Morning roundup

Today's closing of the browser tabs is also a bit of an inbox roundup. A lot of these wind up being from BusinessDesk's excellent news summaries.

- Tyler Barugh aims to either be the monopoly supplier of milk to Wellington, or to have Wellington Council abolish its antique and unused century-old milk supply legislation.

- NZ's natural gas shortage has eased a bit, but there's still risk that industrial users will be asked to curb their production if electricity companies need the stuff. Meanwhile, Red Radio worries that NZ's ban on oil and gas exploration isn't tough enough.

- The Auditor General isn't happy about how the NZ Govt handed out tourism grants. It looks like there was ample opportunity for dodginess given the lack of process.

- Mastery, then innovation.

- Seventy of some 400ish Fellows of the Royal Society of New Zealand have signed an open letter wishing that the Royal Society return to favouring science - and noting that more would have signed on except they said they feared reprisals. Something is deeply wrong with the Royal Society.

- RBNZ is reviewing its monetary policy remit.

- More on the traditional media (ie Murdoch) using government to strong-arm tech platforms.

- The government continues to ease official Covid restrictions. My personal restrictions remain in place:

- Wear a solid N95 mask when indoors; wear a decent mask (like my Cactus Outfitters one) when outdoors in more crowded spaces;

- Avoid indoor places that attract unmasked people;

- Prefer places that continue to enforce vax passes, as they will discourage riskier people from attending;

- Do not dine or drink indoors unless very sure that the ventilation is very good indeed.